Risk-Based Approach (RBA) to AML & KYC risk management

Implementing a Risk-Based Approach in AML and KYC: Strategies for Effective Risk Management.

This article presents an in-depth exploration of the Risk-Based Approach (RBA) as a critical tool for compliance teams in the fight against money laundering and terrorist financing. It explains how RBA necessitates a thorough understanding of the risks inherent within an organisation and the development of tailored controls to address these risks. The focus is on prioritising efforts based on the severity and likelihood of risks, thereby optimising resource allocation and enhancing the effectiveness of compliance measures. The article offers a detailed guide on how to implement RBA, including risk assessment methodologies, policy formulation, and staff training, ultimately providing a roadmap for compliance teams to strategically focus their efforts where they are most needed and impactful.

The Risk-Based Approach (RBA) is a strategic framework focused on proactively identifying and managing the potential risks of money laundering and terrorist financing that a business may encounter.

It involves a systematic assessment of these risks, aligning them with robust and effective control measures. Rather than merely reacting to incidents of money laundering through post-event analysis, RBA emphasises preemptive risk management, guiding financial institutions to actively anticipate and mitigate risks.

Risk-Based Approach (RBA) requires an organisation to thoroughly understand its exposure to money laundering and terrorist financing risks, and to develop tailored control mechanisms. These controls are designed and prioritised based on the severity and likelihood of the risks identified. Commonly employed by compliance teams, this approach directs resources and efforts proportionally to the level of risk, ensuring that higher risks receive more attention and resources.

Risk-Based Approach (RBA) dictates that countries, regulatory authorities, and financial entities must not only identify and assess the risks of money laundering and terrorist financing they face but also understand these risks comprehensively. Following this understanding, they are required to implement appropriate and proportionate mitigation measures. These measures should correspond directly to the intensity of the identified risks, ensuring a balanced and effective approach to managing potential threats in the financial sector.

Risk-Based Approach (RBA) to Anti-Money Laundering

The Risk-Based Approach (RBA) in the context of Anti-Money Laundering (AML) is a methodological framework that prioritises and allocates resources to areas deemed as higher risks. This approach is dynamic and adaptable, allowing for a more focused and efficient use of resources in combating money laundering and terrorist financing. It contrasts with a ‘one-size-fits-all’ strategy, instead advocating for measures that are proportionate to the nature, size, and risk exposure of the entity.

In the RBA, financial institutions and obliged entities assess the likelihood and potential impact of money laundering risks specific to their operations. Based on this assessment, they design and implement controls and mitigation strategies that are commensurate with the identified risks. This process involves a continuous cycle of risk identification, assessment, mitigation, and monitoring.

Importance and Benefits of RBA in Risk Management

- Enhanced Effectiveness: By focusing on higher-risk areas, RBA ensures that efforts and resources are directed where they are most needed, enhancing the effectiveness of AML programs.

- Cost-Efficiency: RBA avoids the wasteful allocation of resources to low-risk areas, allowing for more efficient use of funds and personnel.

- Regulatory Compliance: Many regulatory bodies globally have adopted the RBA, making it not just a best practice but a compliance requirement. It aligns with international standards set by bodies like the Financial Action Task Force (FATF).

- Flexibility and Adaptability: RBA allows organisations to quickly adapt to emerging threats or changes in the risk landscape, unlike more rigid, traditional models.

- Informed Decision-Making: RBA fosters a deeper understanding of the specific risks faced by an entity, leading to more informed and effective decision-making in AML strategies.

Transition from Traditional to Risk-Based Models

The shift from traditional, prescriptive AML models to a Risk-Based Approach represents a significant paradigm change in financial crime risk management. Traditional models often revolved around strict adherence to predefined rules and thresholds, regardless of the specific risk context of an entity. This often led to a ‘tick-box’ culture, where compliance was more about meeting set criteria rather than effectively managing risks.

The transition to RBA requires a cultural and operational shift:

- Risk Assessment: Entities must conduct comprehensive risk assessments to understand their unique risk exposures.

- Policies and Procedures: Development of policies and procedures that are tailored to the risk profile, rather than generic.

- Training and Awareness: Staff need training not just in compliance procedures but in understanding and identifying risks.

- Technology and Data Analysis: Leveraging technology for better risk analysis and management.

- Continuous Monitoring and Review: A shift towards ongoing monitoring of risk profiles and effectiveness of controls, rather than periodic compliance checks.

This transition, while challenging, positions organisations to more effectively combat money laundering and terrorist financing, and to respond with agility to the evolving risk landscape.

The Risk-Based Approach (RBA) Framework

Fundamental Concepts and Categories of Risk

The RBA framework in anti-money laundering (AML) and counter-terrorist financing (CTF) is centred around the identification, assessment, mitigation, and ongoing monitoring of risks. This framework requires a nuanced understanding of various categories of risk, which can broadly be classified as:

- Customer Risks: These risks arise from the diverse nature of customers. Factors such as the customer’s background, occupation, business activities, and the transparency of their source of funds or wealth contribute to the risk profile. High-risk customers might include politically exposed persons (PEPs), those from countries with inadequate AML controls, or individuals involved in industries prone to money laundering.

- Product and Service Risks: Different financial products and services carry varying levels of risk. Products that offer higher anonymity, cross-border transactions, complex structures, or those that inherently have higher cash flows are considered riskier. Examples include private banking, correspondent banking, and certain types of electronic payment services.

- Geographical Risks: These are associated with the countries or regions in which the entity operates, as well as those with which its customers have connections. Countries with high levels of corruption, weak AML regulations, known tax havens, or those under international sanctions are typically deemed higher risk.

Transactional Risks: These relate to the nature and patterns of transactions conducted by customers. Unusual transaction patterns, transactions that do not align with a customer’s profile, high-volume or high-value transactions, and transactions involving high-risk countries are potential risk indicators.

The RBA Process: Identification, Assessment, Mitigation, Monitoring

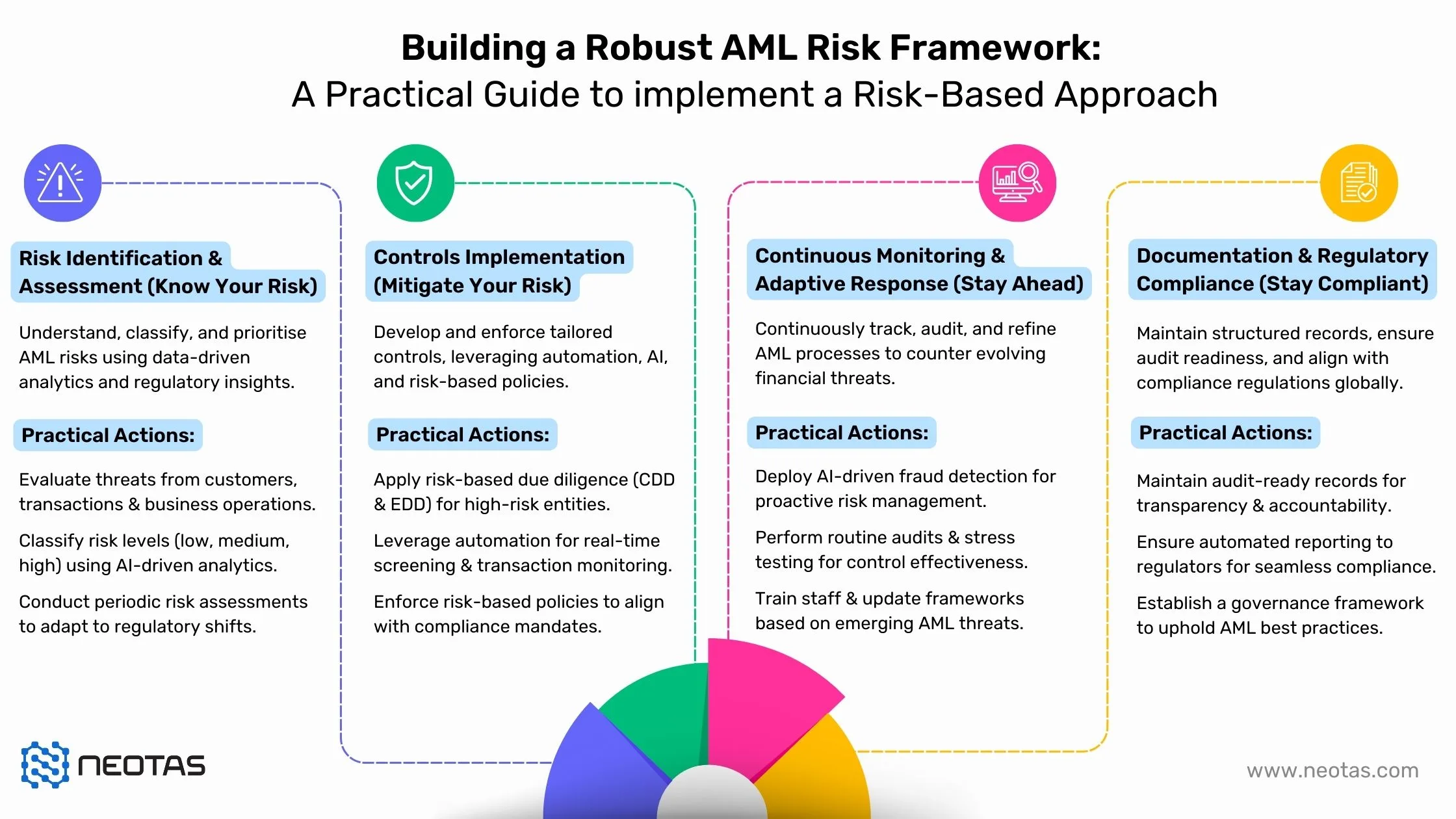

A Risk-Based Approach (RBA) is central to effective Anti-Money Laundering (AML) compliance, ensuring that resources are allocated where they are most needed. Unlike rigid, rule-based frameworks, an RBA prioritises threats dynamically, enabling financial institutions to detect, assess, and mitigate risks efficiently.

This structured process allows organisations to:

✔ Identify high-risk customers, transactions, and business relationships.

✔ Assess risks based on severity, impact, and likelihood.

✔ Implement proportionate controls tailored to the level of risk exposure.

✔ Continuously monitor and adapt to emerging financial crime threats.

By adopting an RBA, institutions strengthen their compliance posture, enhance fraud detection, and build resilience against regulatory scrutiny.

1. Risk Identification: Establishing the Threat Landscape

The first step in the RBA process is to identify potential risks associated with customers, transactions, products, services, and jurisdictions. This involves:

✔ Customer Risk Profiling – Categorising customers based on factors such as business activity, transaction behaviour, political exposure (PEPs), and geographic presence.

✔ Product & Service Risks – Assessing the inherent risk of financial products, such as anonymous transactions, high-value transfers, and cross-border payments.

✔ Geographic Risks – Evaluating exposure to high-risk jurisdictions with weak AML enforcement or a history of financial crime.

✔ Delivery Channel Risks – Reviewing risks associated with digital banking, correspondent banking, and third-party service providers.

Why It Matters: Identifying risks at an early stage allows institutions to preemptively apply controls where they are most needed

2. Risk Assessment: Quantifying & Prioritising Risks

Once risks are identified, they must be evaluated based on likelihood and impact to ensure effective prioritisation. Key steps include:

✔ Risk Scoring & Categorisation – Assigning risk ratings (Low, Medium, High) based on quantitative models and qualitative assessments.

✔ Transaction Pattern Analysis – Identifying anomalies in frequency, volume, and destination of transactions to detect potential illicit activity.

✔ Regulatory Impact Assessment – Aligning internal risk evaluations with jurisdictional AML regulations and international compliance standards (FATF, EU, FinCEN, etc.).

Why It Matters: A well-structured risk assessment model ensures that AML resources are allocated proportionately, preventing unnecessary scrutiny on low-risk entities while enhancing oversight of high-risk areas.

3. Risk Mitigation: Implementing Proportionate Controls

Once risks are assessed, financial institutions must implement tailored controls to reduce exposure while maintaining operational efficiency.

✔ Enhanced Due Diligence (EDD) – Applied to high-risk customers and transactions, involving source of funds verification, transaction monitoring, and ongoing scrutiny.

✔ Simplified Due Diligence (SDD) – Used for low-risk clients, reducing unnecessary compliance burdens while maintaining basic AML checks.

✔ Transaction Monitoring & Alerting – Deploying AI-driven monitoring systems to detect suspicious activity in real time.

✔ Automated Sanctions & PEP Screening – Ensuring customers and business relationships comply with sanctions lists, watchlists, and adverse media checks.

Why It Matters: Effective risk mitigation strategies ensure that AML frameworks remain agile, cost-efficient, and fully compliant with regulatory expectations.

4. Continuous Monitoring & Adaptive Response

AML risks evolve over time, requiring continuous oversight and system adjustments. Institutions must establish ongoing risk management practices such as:

✔ Dynamic Risk Reassessment – Regularly updating customer risk profiles and business-wide risk assessments based on new data.

✔ Regulatory Compliance Audits – Conducting periodic AML audits to ensure policies align with latest industry regulations.

✔ Machine Learning & AI Integration – Using predictive analytics to identify emerging money laundering trends before they escalate.

✔ Suspicious Activity Reporting (SARs) – Ensuring timely escalation of high-risk transactions to regulatory authorities.

Why It Matters: By continuously adapting to emerging financial crime trends, institutions can stay ahead of regulatory requirements while safeguarding their operations.

The Competitive Advantage of a Robust RBA

A well-implemented Risk-Based Approach delivers tangible benefits, including:

✔ Increased AML efficiency by focusing efforts where risk exposure is highest.

✔ Regulatory compliance alignment with FATF, EU AML directives, FinCEN, and other governing bodies.

✔ Enhanced fraud detection & prevention through data-driven risk monitoring.

✔ Stronger institutional resilience against financial crime threats.

By adopting a structured RBA process, financial institutions not only strengthen their compliance posture but also enhance operational agility, improve risk governance, and foster trust with regulators, clients, and stakeholders.

Practical Implementation: Essential Tools & Technologies

1. Technology in RBA: AI, Machine Learning, and Automation

✔ AI-Driven Risk Detection – Automates AML risk assessments with advanced pattern recognition.

✔ Machine Learning Models – Predictive analytics for fraud prevention and customer risk profiling.

✔ Automated Compliance Workflows – Reducing manual effort and enhancing regulatory reporting accuracy.

2. Risk Assessment & Compliance Tools

✔ AML Risk Matrix – Classifies risks based on likelihood and impact.

✔ Watchlist Screening & Adverse Media Checks – Identifies sanctioned entities, PEPs, and financial crime suspects.

✔ Integration with Third-Party Databases – Accessing up-to-date information on global compliance watchlists.

Institutions that leverage technology-driven risk assessment tools streamline compliance, reduce false positives, and enhance risk detection capabilities.

Essential Elements for an Effective Risk-Based Approach in Anti-Money Laundering

A robust risk-based approach (RBA) to anti-money laundering (AML) is fundamental in mitigating financial crime risks while ensuring compliance with regulatory requirements. To be effective, an RBA must incorporate several key elements, each contributing to a resilient AML framework that adapts to evolving threats.

1. Know Your Customer (KYC): Establishing Identity & Legitimacy

A strong KYC framework is the foundation of an effective AML strategy, ensuring that financial institutions can verify and authenticate customer identities while assessing potential risks.

Mandatory Identity Verification

Regulated entities are required to conduct thorough identity verification processes, including:

- Collecting personal information such as full name, residential address, and date of birth.

- Obtaining additional financial details, including occupation and transaction history, for higher-risk clients.

Automated KYC Solutions

The evolution of AML compliance has led to the adoption of automated KYC systems that enhance efficiency, accuracy, and scalability. These systems:

- Enable rapid and seamless customer onboarding through AI-driven verification methods.

- Use advanced techniques such as document authentication, biometric verification, video-based identification, phone validation, and address confirmation.

- Ensure continuous compliance monitoring by adapting to evolving regulatory requirements.

By integrating technology-driven solutions, institutions can enhance operational efficiency while maintaining comprehensive risk oversight.

2. Customer Due Diligence (CDD): Assessing Risk at Every Stage

Beyond identity verification, institutions must continuously evaluate the risk profile of each customer to ensure ongoing compliance and proactive risk management.

Risk Differentiation Among Customers

Recognising that not all customers present the same level of AML risk is essential. Risk assessment should consider:

- Customer type (e.g., individuals, corporations, financial institutions).

- Transaction patterns and deviation from expected behaviours.

- Business nature and geographical exposure to high-risk jurisdictions.

Adaptation of Due Diligence Levels

The degree of due diligence should be proportionate to the risk level identified:

- Simplified Due Diligence (SDD): Applied to low-risk customers with limited AML exposure.

- Standard Due Diligence (CDD): Routine verification and ongoing monitoring for general risk customers.

- Enhanced Due Diligence (EDD): Reserved for high-risk customers, involving deeper scrutiny, source of funds verification, and heightened monitoring.

A risk-based CDD strategy allows institutions to allocate resources effectively, focusing on areas of greatest financial crime vulnerability.

3. Watchlist Screening: Strengthening Compliance & Security

A comprehensive screening framework is essential in identifying and mitigating risks associated with sanctioned entities, politically exposed persons (PEPs), and adverse media exposure.

Key Screening Components

1. Watchlist Screening

Organisations must screen customers and business partners against global regulatory lists, ensuring compliance with:

- Sanctions Lists: Maintained by bodies such as the OFAC (US), EU, UN, and HM Treasury (UK).

- Financial Crime Databases: Including lists from Interpol, FATF, and national law enforcement agencies.

Watchlist screening ensures that institutions do not engage with high-risk or sanctioned individuals and entities, reducing the potential for financial and reputational damage.

2. Adverse Media Screening

Negative news and public records can provide early warning signs of potential risk exposure. Adverse media screening involves:

- Identifying media reports that link individuals or businesses to financial misconduct, fraud, or corruption.

- Flagging potential reputational risks before engagement with customers or business partners.

By leveraging AI-driven adverse media checks, institutions can automate the identification of high-risk entities in real time.

3. PEPs and Sanctions Screening

Politically Exposed Persons (PEPs) are individuals with significant political influence, posing a higher risk of money laundering and corruption. Institutions must:

- Implement enhanced due diligence when engaging with PEPs and their associates.

- Continuously monitor political exposure and potential financial misconduct risks.

Sanctions screening and PEP assessments ensure that financial institutions do not inadvertently facilitate financial crime or violate international regulatory obligations.

A Holistic & Adaptive AML Strategy

An effective risk-based approach to AML requires a dynamic and proactive framework that integrates:

✔ Technology-driven KYC for efficient identity verification and customer onboarding.

✔ Risk-based CDD to continuously assess and adapt due diligence measures.

✔ Comprehensive screening mechanisms to identify high-risk individuals, entities, and transactions.

By embedding these essential elements within their AML frameworks, financial institutions can:

🔹 Strengthen regulatory compliance.

🔹 Protect against financial and reputational damage.

🔹 Stay ahead of evolving money laundering threats.

Institutions that prioritise a robust risk-based approach will not only mitigate exposure but also enhance operational resilience in an increasingly complex financial landscape.

Implementing a Risk-Based Approach in AML

Incorporating these elements into an AML program is not just beneficial; it’s imperative for robust compliance. While constructing such a program from the ground up can be daunting, its importance in maintaining regulatory compliance and preventing financial crimes cannot be overstated. This comprehensive approach ensures that an organisation is not only adhering to legal requirements but also actively contributing to the broader effort against money laundering and associated risks.

The Risk-Based Approach (RBA) to Anti-Money Laundering (AML) represents a fundamental shift from rigid, prescriptive compliance models to a dynamic, intelligence-driven framework that prioritises risks based on their severity and impact. By aligning AML measures with actual risk exposure, organisations can optimise resources, enhance compliance, and improve operational resilience.

1. Enhanced Effectiveness: A Strategic Focus on High-Risk Areas

A risk-based AML framework ensures that compliance efforts are precisely targeted at areas of greatest vulnerability, rather than applied indiscriminately across all activities.

Targeted Risk Management

- RBA enables financial institutions to identify, assess, and prioritise high-risk areas.

- This ensures AML measures are proportionate to the threat level, strengthening defence mechanisms against financial crime.

Improved Risk Awareness

- A well-structured RBA fosters a culture of vigilance, ensuring employees and compliance teams are acutely aware of AML risks.

- By integrating real-time risk monitoring, organisations can proactively detect and prevent illicit financial activities.

Dynamic Adaptation to Emerging Threats

- Financial crime tactics evolve rapidly; a rigid AML framework struggles to keep pace.

- RBA offers adaptability, allowing institutions to respond swiftly to new threats, typologies, and regulatory changes.

A strategic, risk-aligned AML framework enhances the overall effectiveness of financial crime prevention efforts.

2. Improved Efficiency: Maximising Impact with Optimal Resource Allocation

An RBA eliminates inefficiencies inherent in one-size-fits-all AML models, ensuring that compliance efforts are efficient, cost-effective, and scalable.

Resource Optimisation

- Institutions can direct resources towards high-risk areas, avoiding unnecessary expenditure on low-risk activities.

- This risk-prioritised allocation improves both operational performance and regulatory compliance.

Streamlined Processes

- Traditional AML models often impose blanket controls, leading to excessive bureaucracy and inefficiencies.

- RBA fosters simplified, tailored controls, reducing administrative burdens while maintaining compliance integrity.

Data-Driven Decision Making

- By integrating risk assessment tools, predictive analytics, and AI-driven monitoring, institutions can make informed, evidence-based decisions.

- This enhances AML effectiveness while ensuring a proactive rather than reactive approach to financial crime.

Through risk-based efficiencies, organisations achieve greater agility, optimising their AML frameworks while reducing compliance costs.

3. Regulatory Compliance: Meeting Global Standards with Confidence

An RBA is widely endorsed by international regulatory bodies, ensuring alignment with global AML expectations while minimising regulatory risk exposure.

Alignment with International Standards

- Regulatory bodies, including the Financial Action Task Force (FATF), European Union (EU), and national regulators, mandate a risk-based AML approach.

- Adopting RBA ensures seamless compliance with these evolving global regulatory expectations.

Reduced Legal and Reputational Risks

- A well-implemented RBA minimises exposure to financial penalties, sanctions, and legal proceedings arising from AML failures.

- Proactive risk management enhances institutional credibility, safeguarding against reputational damage.

Enhanced Stakeholder Trust

- A structured risk-based AML strategy reassures regulators, investors, partners, and customers of an organisation’s commitment to financial integrity.

- Demonstrating compliance leadership fosters greater trust, transparency, and long-term financial stability.

By integrating RBA best practices, financial institutions not only meet regulatory requirements but also strengthen their market position.

Why the Risk-Based Approach is the Future of AML

The Risk-Based Approach provides a more intelligent, scalable, and effective method for managing money laundering risks compared to traditional, prescriptive models.

✔ Improves AML effectiveness by targeting high-risk activities with precision.

✔ Optimises resource allocation, ensuring compliance costs are justified by risk exposure.

✔ Strengthens regulatory alignment, reducing the risk of non-compliance penalties.

✔ Enhances agility, allowing institutions to adapt quickly to emerging financial crime threats.

In an increasingly complex financial landscape, organisations that embrace a risk-based AML strategy will not only ensure compliance but will build more resilient, future-proof AML frameworks that uphold financial security, trust, and integrity.

Risk-Based Approach in Anti-Money Laundering (AML) & Know Your Customer (KYC)

The Risk-Based Approach (RBA) plays a pivotal role in Anti-Money Laundering (AML) and Know Your Customer (KYC) processes by tailoring the intensity and nature of due diligence to the risk profile of customers and transactions. This approach allows financial institutions and other obliged entities to concentrate their efforts and resources on higher-risk areas, thereby enhancing the effectiveness and efficiency of their AML and KYC measures.

Common AML Risk Factors:

- Individual Risks:

- Customer Profile: Risks vary based on the customer’s occupation, public status (e.g., Politically Exposed Persons – PEPs), financial background, and behaviour.

- Customer History: Past incidents of non-compliance or suspicious activities increase risk levels.

- Geographic Risks:

- Country Risk: Countries with weak AML regulations or high levels of corruption and political instability are considered higher risk.

- Cross-Border Transactions: International transactions, especially with high-risk countries, are often subject to increased scrutiny.

- Channel Risks:

- Delivery Channels: Non-face-to-face interactions and digital channels can elevate risk due to anonymity concerns.

- Third-Party Relationships: Dependence on external parties for customer introduction or transactions can introduce additional risks.

- Transaction Risks:

- Nature and Complexity: Unusual, complex, or unusually large transactions can be indicative of money laundering.

- Transaction Patterns: Frequent or irregular transactions that don’t align with the customer’s profile can be suspicious.

RBA’s Role in Managing AML and KYC Risks:

- Customised Due Diligence: RBA allows for more intensive due diligence for higher risk customers while streamlining processes for lower-risk customers.

- Continuous Monitoring: Ongoing monitoring of transactions and customer activity, adjusted based on their risk profile.

- Adaptive Measures: Adjusting AML and KYC measures in response to changes in a customer’s risk profile or emerging risks.

FATF Recommendations and Global Standards:

The Financial Action Task Force (FATF) recommends the use of RBA in AML and KYC. These recommendations guide countries and financial institutions in developing AML policies that are both effective and flexible. The key is to identify, assess, and understand the money laundering and terrorist financing risks and to mitigate them with appropriate measures.

Developing an AML Risk-Based Matrix:

An AML Risk-Based Matrix is a tool for categorising and managing risks. It involves:

- Risk Categorisation: Identifying different risk categories (individual, geographic, channel, transaction).

- Risk Assessment: Evaluating the likelihood and impact of risks in each category.

- Risk Scoring: Assigning scores to risks based on their assessed severity and likelihood.

- Control Measures: Determining appropriate controls for different risk levels.

- Monitoring and Review: Regularly reviewing and updating the risk matrix to reflect changes in risk profiles or the external environment.

The RBA ensures that AML and KYC measures are not only compliant with legal requirements but are also strategically aligned with the specific risk profile of each customer or transaction, thereby making the fight against financial crime more targeted and effective.

Regulatory Guidance and Best Practices for Risk-Based Approach (RBA) in AML/KYC

The adoption of a Risk-Based Approach (RBA) in Anti-Money Laundering (AML) and Know Your Customer (KYC) processes is strongly influenced by global and regional regulatory frameworks and best practices. The cornerstone of these regulatory guidelines is the Financial Action Task Force (FATF), which sets international standards.

FATF Recommendations for RBA:

- Risk Assessment and Management: FATF recommends that countries and financial institutions identify, assess, and understand their money laundering and terrorist financing risks and take action to mitigate these risks.

- Customer Due Diligence: Enhanced due diligence for higher-risk customers and simplified measures for lower-risk scenarios.

- Record Keeping: Maintaining comprehensive records of risk assessments and mitigative actions.

- Reporting Suspicious Transactions: Reporting any unusual or suspicious transactions identified under the RBA.

- Ongoing Monitoring: Continuously monitoring the risk level and adjusting AML/KYC measures accordingly.

Sector-Specific Guidance:

- Banking: Enhanced due diligence for private banking, correspondent banking, and customers from high-risk countries. Emphasis on transaction monitoring and verifying the source of funds.

- Securities: Focus on identifying risks related to market manipulation and insider trading. Monitoring complex trading patterns and large transactions.

- Other Financial Services: Inclusive of insurance, fintech, and cryptocurrencies. The focus here includes the understanding of new technologies and their potential for misuse, and monitoring transactions involving high-risk jurisdictions.

Global vs. Regional Regulatory Perspectives:

Global Perspective (FATF): Provides a broad framework for AML/KYC compliance applicable across different jurisdictions. It offers the flexibility for countries to implement these standards based on their specific risk environments.

Regional and National Regulatory Bodies:

- Financial Conduct Authority (FCA) – UK: Focuses on ensuring that financial markets operate fairly and transparently, with a strong emphasis on consumer protection and market integrity.

- General Data Protection Regulation (GDPR) – EU: Although primarily focused on data protection, it has implications for AML/KYC, particularly in terms of customer data handling and sharing.

- Other Regional Bodies: Each region (like the European Union, ASEAN, etc.) may have specific regulatory bodies and frameworks which address local financial crime risks and compliance standards.

Best Practices for Implementing RBA:

- Customisation to Business Model: Tailoring the RBA to fit the specific business model and risk exposure of the institution.

- Staff Training: Regular training for staff to recognise and effectively manage AML risks.

- Technology Utilisation: Leveraging technology for efficient risk assessment and monitoring.

- Collaboration and Information Sharing: Working with regulatory bodies and participating in information sharing initiatives to stay updated on emerging risks.

The RBA in AML and KYC requires a nuanced application of FATF recommendations, tailored to sector-specific needs and aligned with both global and regional regulatory expectations. Emphasis is placed on a proactive and flexible approach to identifying and mitigating financial crime risks, ensuring regulatory compliance and safeguarding the integrity of the financial system.

Implementing Risk-Based Approach in Various Sectors

Implementing a Risk-Based Approach (RBA) in different sectors, particularly in banking, involves customising the methodology to address the unique risks and regulatory requirements of each sector.

Risk-Based Approach in Banking

Banking institutions face diverse and often complex money laundering and terrorist financing risks, making RBA implementation critical. In banking, RBA involves:

- Customer Risk Profiling: Assessing the money laundering risk of customers based on factors like occupation, source of funds, transaction patterns, and geography.

- Transaction Monitoring: Continuously monitoring customer transactions to identify patterns that may indicate money laundering or terrorist financing.

- Product Risk Assessment: Evaluating the risks associated with different banking products and services, particularly those that offer higher levels of anonymity or are prone to misuse.

- Geographic Risk Analysis: Considering the risks associated with operating in or transacting with high-risk countries or regions.

- Internal Controls and Policies: Developing robust internal controls and policies that reflect the identified risks, including procedures for customer due diligence, reporting, and record-keeping.

Overview of FATF Recommendations

The Financial Action Task Force (FATF) sets international standards for combating money laundering and terrorist financing, and its recommendations form the cornerstone of RBA implementation. Key FATF recommendations include:

- Risk Assessment: Countries and financial institutions should conduct a comprehensive risk assessment to understand their exposure to money laundering and terrorist financing risks.

- Mitigation Measures: Implement measures to mitigate identified risks proportionate to their severity.

- Supervisory and Regulatory Systems: Establish effective systems to monitor and ensure compliance with AML/CFT measures.

- Transparency and Cooperation: Enhance transparency and promote international cooperation to combat money laundering and terrorist financing.

Risk-Based Approach Implementation Guidance for Banks and Supervisors

For Banks:

- Risk Assessment Process: Develop and maintain a risk assessment process that is regularly updated to reflect changing risk landscapes.

- Customer Due Diligence (CDD): Implement enhanced due diligence for high-risk customers and simplified measures for lower-risk groups.

- Employee Training: Ensure regular training for employees to understand and apply RBA in their roles effectively.

- Reporting and Compliance: Establish a culture of compliance with clear reporting lines and procedures for suspicious activity reporting.

For Supervisors:

- Regulatory Framework: Create a regulatory framework that supports and enforces the implementation of RBA in banks.

- Guidance and Resources: Provide banks with guidance, resources, and training on effectively implementing RBA.

- Oversight and Monitoring: Regularly monitor banks to ensure compliance and provide feedback on their RBA processes.

- Sanction and Enforcement Mechanisms: Implement mechanisms to sanction non-compliance and encourage adherence to AML/CFT regulations.

Implementing RBA in banking requires a comprehensive and dynamic approach, integrating FATF recommendations, custom risk assessments, and continuous monitoring. Both banks and regulatory supervisors play crucial roles in ensuring the effectiveness of RBA, ultimately enhancing the integrity and security of the financial sector against money laundering and terrorist financing threats.

The Role of Risk Assessment Skills in Compliance

In compliance, particularly in Anti-Money Laundering (AML) and Know Your Customer (KYC) operations, risk assessment skills are paramount. These skills enable compliance professionals to navigate a complex landscape of regulatory requirements, financial threats, and evolving criminal tactics effectively.

Identifying Compliance Risks:

- Comprehending Regulatory Requirements: Understanding the spectrum of applicable laws, regulations, and guidelines is fundamental. This includes not only domestic legislation but also international standards like those set by the FATF.

- Industry-Specific Risks: Each industry, whether banking, insurance, or securities, has unique risk profiles. Proficiency in identifying these sector-specific risks is essential.

- Emerging Threats: Staying abreast of emerging risks, such as new forms of financial fraud or changes in money laundering techniques, is critical.

Implementing Controls:

- Tailored Risk Mitigation: Based on the identified risks, compliance officers need to design and implement controls that are proportionate and effective. This could involve enhanced due diligence processes, transaction monitoring systems, and customer risk assessments.

- Adapting to Risk Dynamics: As risks evolve, controls must be reassessed and adapted. This requires ongoing monitoring and a dynamic approach to risk management.

- Training and Awareness: Ensuring that all staff, not just those in compliance roles, are trained and aware of compliance risks and the controls in place to mitigate them.

Managing Policy Changes:

- Regulatory Updates: Compliance professionals must adapt policies in response to changes in legislation and regulatory guidance. This includes updating procedures, systems, and training programmes.

- Internal Policy Review: Regularly reviewing and updating internal policies to ensure they remain effective and aligned with both the external regulatory environment and internal business changes.

- Stakeholder Engagement: Effectively communicating policy changes to all relevant stakeholders, including management, employees, and, where appropriate, customers.

Reporting and Accountability:

- Compliance Reporting: Regular reporting on compliance matters to senior management, regulators, and other stakeholders. This includes reporting on the effectiveness of controls and any breaches or suspicious activities.

- Audit and Review: Facilitating or conducting audits and reviews to assess the effectiveness of compliance policies and controls.

- Responsibility and Culture: Fostering a culture of compliance and ethics throughout the organisation, where responsibility for compliance is shared and understood.

Risk assessment skills in compliance are indispensable for identifying potential compliance risks, implementing appropriate controls, managing policy changes, and ensuring effective reporting and accountability. These skills are crucial in navigating the ever-changing regulatory landscape, managing emerging threats, and sustaining a robust compliance culture within an organisation.

Risk-Based Approach in Auditing

In various sectors, especially in financial services and data protection, a Risk-Based Approach (RBA) to auditing is becoming increasingly vital. This approach prioritises risks and allocates audit resources where they are most needed, ensuring that key areas of potential non-compliance or vulnerability are addressed efficiently.

- Financial Sector and FCA’s Risk-Based Approach:

- The Financial Conduct Authority (FCA) in the UK advocates for an RBA in auditing, focusing on the areas with the highest risk of non-compliance or financial crime.

- Audits in the financial sector under this approach assess risks related to market abuse, financial crime, customer protection, and integrity of financial reporting.

- The FCA’s RBA aims to identify emerging risks, ensuring that financial institutions maintain high compliance standards and respond effectively to changes in the regulatory landscape.

- Data Protection and GDPR’s Application of RBA:

- The General Data Protection Regulation (GDPR) emphasises the importance of risk assessment in protecting personal data.

- Audits under GDPR involve evaluating the risks associated with data processing activities, particularly concerning personal data breaches and misuse.

- The focus is on ensuring that organisations implement adequate technical and organisational measures to safeguard personal data, proportionate to the level of risk.

- Internal Audit and Risk-Based Auditing:

- Risk-based auditing in an internal audit context involves prioritising audit work towards the areas that represent the greatest risk to an organisation’s objectives.

- This approach ensures that audit resources are efficiently used by focusing on the most critical controls and processes.

- Internal audits under this methodology aid in identifying weaknesses in risk management practices and in suggesting improvements.

- Customer Due Diligence and KYC Procedures:

- In customer due diligence (CDD) and Know Your Customer (KYC) procedures, RBA plays a critical role in identifying the risk level of each customer.

- Audits in this area assess the adequacy of CDD and KYC procedures in identifying, assessing, and managing customer-related risks.

- The aim is to ensure that financial institutions are not inadvertently facilitating money laundering or terrorist financing and are compliant with AML regulations.

A Risk-Based Approach in auditing, whether in the financial sector, data protection, internal audit processes, or CDD and KYC procedures, focuses on identifying and assessing risks and allocating audit resources to the areas where they are most needed. This approach not only enhances the effectiveness of the audit process but also ensures that organisations remain compliant with regulatory requirements and protect themselves from potential risks.

Challenges and Critiques of RBA

While the Risk-Based Approach (RBA) to Anti-Money Laundering (AML) and compliance offers many benefits, it also faces certain challenges and criticisms.

Limitations and Criticisms of the RBA:

- Complexity in Risk Assessment: Accurately identifying and assessing risks can be complex and resource-intensive. There’s a risk of either underestimating or overestimating threats.

- Dependence on Quality Data: RBA’s effectiveness hinges on the availability of high-quality, relevant data. Poor data quality can lead to inaccurate risk assessments.

- Subjectivity: Decisions about risk levels can be subjective and vary significantly between assessors.

- Balancing Act: Ensuring a balance between being too risk-averse, which can stifle business, and being too lenient, which can expose the organisation to vulnerabilities.

Addressing the Challenges of Implementing RBA:

- Investment in Technology and Training: Adopting advanced technologies like AI and ML, and training staff in risk assessment and compliance are critical.

- Standardisation of Risk Assessments: Developing standard procedures and methodologies can help reduce subjectivity and inconsistency in risk assessments.

- Regular Reviews and Updates: Continuously updating risk assessments and control mechanisms in response to new threats and changes in the regulatory environment.

Future Outlook and Evolving Landscape of RBA:

- Technology Integration: Continuous integration of newer technologies for more efficient and accurate risk management.

- Global Regulatory Alignment: Further alignment and harmonisation of global regulatory standards can enhance the effectiveness of RBA across borders.

- Focus on Emerging Risks: Increased attention to emerging risks, such as those associated with cryptocurrencies and fintech innovations.

Regulatory Resources and Further Reading:

- FATF Guidance on RBA: Provides comprehensive guidance on implementing RBA as per FATF recommendations.

- EU Directive on Money Laundering: Details about AML directives within the EU.

- Financial Conduct Authority (FCA) Guidelines: Offers guidance on RBA and AML for firms under its regulation.

- Journal of Money Laundering Control: A publication offering insights and research on money laundering trends and control strategies.

- ‘Compliance and Risk Management Strategies’ by John Smith: A book focusing on the implementation of effective compliance and risk management practices.

Also, Read about Anti-Money Laundering (AML) Compliance and Checks

Why the Risk-Based Approach is Essential for AML Compliance

Financial institutions that adopt an advanced Risk-Based Approach will:

✔ Enhance AML effectiveness by focusing compliance efforts on high-risk activities.

✔ Reduce false positives & optimise compliance budgets.

✔ Ensure global regulatory alignment with FATF, FCA, EU, & FinCEN directives.

✔ Future-proof AML frameworks against evolving financial crime threats.🔹 The future of AML compliance is risk-driven. Is your organisation ready?

FAQs on Risk-Based Approach

What is a risk-based approach?

A risk-based approach (RBA) is a method that prioritises risks, focusing on the most significant threats to allocate resources effectively and enhance decision-making processes in various domains like AML, KYC, and compliance. Here is detailed guide to What is a Risk-Based Approach and the Key Components of a Risk-Based Approach.

What are risk-based approach methods?

Risk-based approach methods involve identifying, assessing, prioritising, and managing risks. These methods help organisations tailor their strategies to address specific risks effectively.

What is under a risk-based approach?

Under a risk-based approach, organisations evaluate potential risks in their operations, such as financial, legal, and reputational risks, and implement controls proportionate to the level of risk.

What are the phases of a risk-based approach?

The phases include risk identification, risk assessment, risk prioritisation, risk mitigation, and continuous monitoring and review.

What are the 4 pillars of a risk-based approach?

The four pillars include risk identification, risk assessment, risk control measures, and continuous monitoring and review.

What are the core requirements of a risk-based approach?

Core requirements include comprehensive risk assessment, tailored control measures, continuous monitoring, and effective communication and reporting mechanisms.

How do you adopt a risk-based approach?

Adopting a risk-based approach involves conducting a thorough risk assessment, implementing risk-based controls, regularly reviewing and updating the risk profile, and ensuring staff are trained and aware of the approach.

What are the 5 risk management approaches?

The five approaches include risk avoidance, risk reduction, risk sharing, risk retention, and risk exploitation.

What are the three approaches to risk management?

The three main approaches are risk avoidance, risk transfer, and risk mitigation.

What is the opposite of a risk-based approach?

The opposite is a prescriptive or rules-based approach, which applies uniform controls without considering the specific level of risk.

What is the difference between risk management and a risk-based approach?

Risk management involves identifying and addressing risks, while a risk-based approach prioritises risks to focus efforts and resources on the most critical areas.

What are the two basic approaches to risk management?

The two basic approaches are the traditional risk management approach, focusing on avoiding losses, and the enterprise risk management approach, which also considers strategic risks.

What is the risk-based approach to prioritisation?

This approach involves ranking risks based on their severity and likelihood to ensure that the most critical risks are addressed first.

What are the key elements of a risk management approach?

Key elements include risk identification, risk analysis, risk evaluation, risk treatment, and continuous monitoring.

What is the 4-step approach to risk management?

The four steps are identifying risks, assessing risks, controlling risks, and monitoring and reviewing the control measures.

What are the three phases of a risk-based audit approach?

The three phases include planning (risk identification and assessment), execution (testing controls), and reporting (communicating findings and recommendations).

What is the main objective of using the risk-based approach?

The main objective is to efficiently allocate resources to the areas of highest risk to enhance the effectiveness of risk management practices.

What is the nature of a risk-based approach?

The nature of an RBA is proactive and dynamic, focusing on identifying and mitigating risks before they materialise, based on their likelihood and impact.

What is the difference between a rule-based approach and a risk-based approach?

A rule-based approach applies uniform standards regardless of risk, while a risk-based approach tailors controls to the level of risk.

What are the key benefits of adopting a risk-based approach?

Key benefits include improved resource allocation, enhanced decision-making, increased compliance, and better risk mitigation.

What is an example of a risk management approach?

An example is a company performing regular cybersecurity assessments to identify vulnerabilities and implementing targeted security measures to mitigate identified risks.

What is an example of good risk management?

Good risk management could be a financial institution conducting thorough customer due diligence to prevent money laundering.

What are the 7 types of risk management?

The seven types include financial, operational, reputational, compliance, strategic, environmental, and health and safety risk management.

What is the ideal approach for managing risk?

The ideal approach is context-specific, combining various risk management strategies to address the unique risk profile of an organisation effectively.

What is an example of risk avoidance?

Risk avoidance might involve a company deciding not to enter a high-risk market to prevent potential losses.

When should a risk be avoided?

A risk should be avoided when its potential impact is unacceptable to the organisation or when mitigation costs outweigh the benefits.

About Neotas Due Diligence

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team. It’s a world-first, searching beyond Google. Neotas’ diligence uncovers illicit activities, reducing financial and reputational risk.

Due Diligence Solutions:

- Enhanced Due Diligence

- Management Due Diligence

- Customer Due Diligence

- Simplified Due Diligence

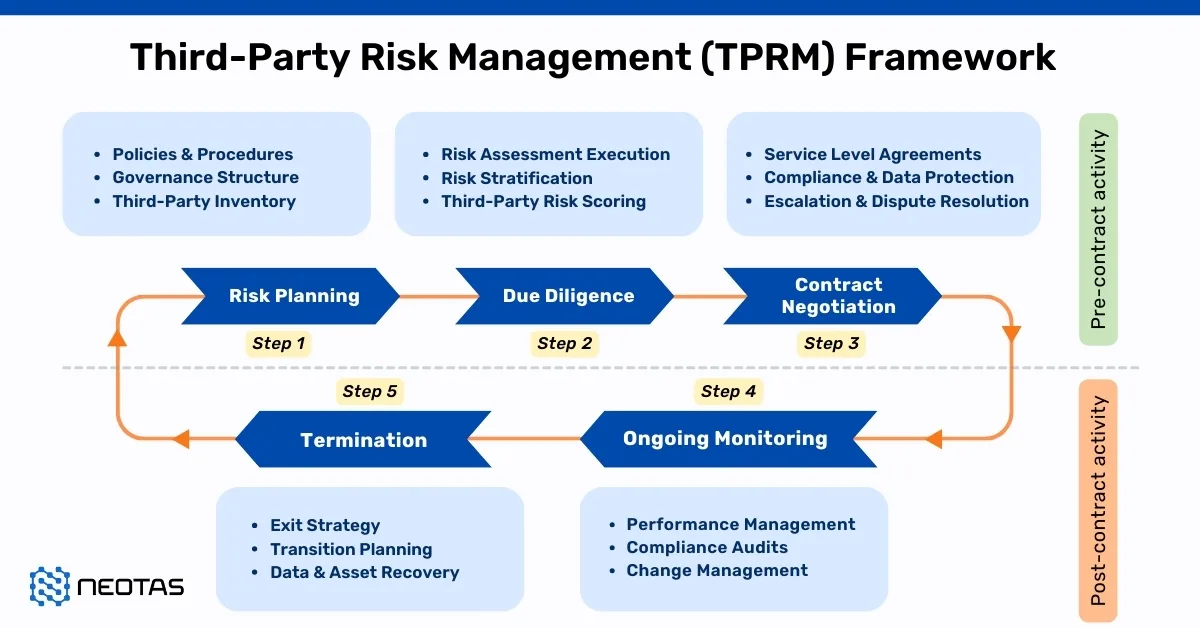

- Third Party Risk Management

- Open Source Intelligence (OSINT)

- Customer Due Diligence Requirements

- Risk-Based Approach (RBA) to AML & KYC risk management

- Anti-Money Laundering (AML) Compliance and Checks

- Introducing the Neotas Enhanced Due Diligence Platform

Risk-Based Approach and AML Case Studies:

- Case Study: OSINT for EDD & AML Compliance

- Overcoming EDD Challenges on High Risk Customers

- Neotas Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- ESG Risks Uncovered In Investigation For Global Private Equity Firm

- Management Due Diligence Reveals Abusive CEO

- Ongoing Monitoring Protects Credit Against Subsidiary Threat

- AML Compliance and Fraud Detection – How to Spot a Money Launderer and Prevent It

- What is Customer Due Diligence in Banking and Financial Services?