Private Equity Risk: What You Don’t Know Can Hurt You :

That stupid saying “What you don’t know can’t hurt you” is ridiculous. What you don’t know can kill you. If you don’t know that tractor trailer trucks hurt when hitting you, then you can play in the middle of the interstate with no fear – but that doesn’t mean you won’t get killed. — Dave Ramsey

According to McKinsey’s 2021 Private Markets Annual Review, private equity has outperformed other asset classes and experienced less volatility than any year since 2008.

The review suggests that more institutions and wealthy individuals are turning to private equity (PE) to supplement and bolster the returns of their traditional investment portfolios as the markets remain largely unpredictable.

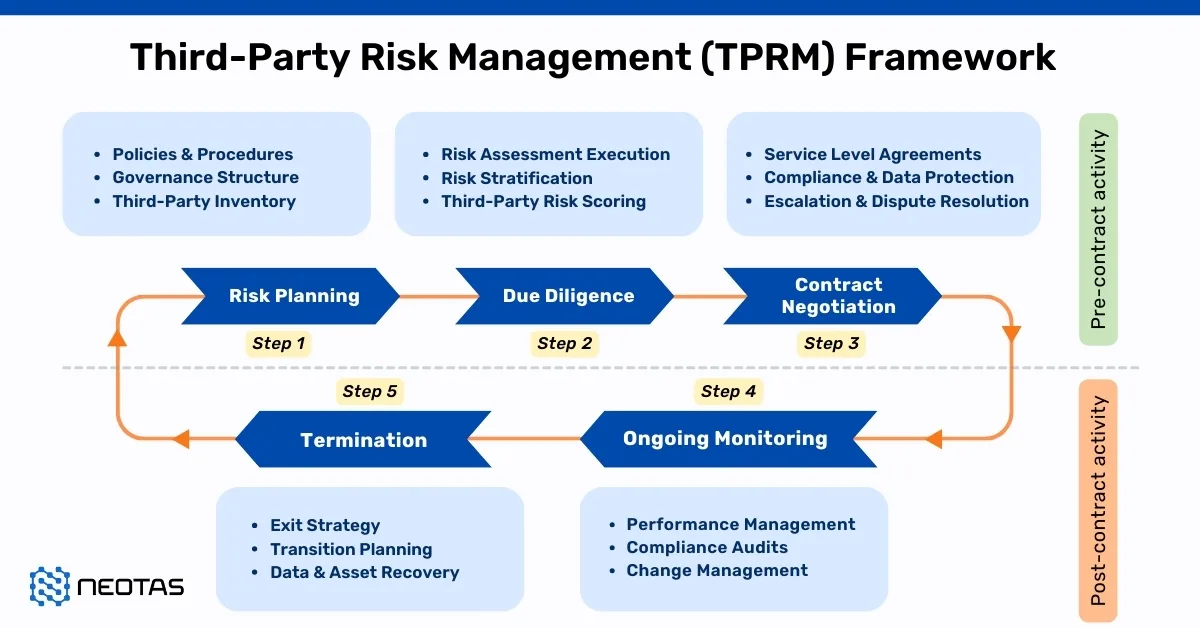

Increased levels of activity can lead to a host of new challenges and private equity risks, as the appetite for dealmaking forces a sense of urgency – meaning that due diligence can at times be overlooked or under-executed.

New Challenges for PE Investment Firms

Deloitte predicts that global PE assets will reach $5.8 trillion by 2025, significantly above the $4.5 trillion at the end of 2019. The significant increases in PE funds inevitably create new pressures on those responsible for investing the new capital and greater risk for their investors. Here are some of the reasons why:

Demand for rapid deployment of funds

According to MarketWatch, the top 25 private-equity firms had $509.8 billion in uninvested cash at the end of the 2nd quarter of 2021. Some claim they have more money than potential investments.

With “excess” funds and a demand for deals, firms are diversifying into new industries and geographies with limited experience.

Increased competition

The number of private equity firms raising investor funds and seeking investments has increased on average about 7% each year since 2013, with an estimated 9,000 globally in 2021. The number of completed investments has been stable since 2015, while investment totals have increased.

While demand for high-return investments has grown with the new investment totals, the supply of potential investments capable of delivering such high rates has remained stable.

The PE firms compete for the desirable opportunities, driving up valuations and increasing risk. Simply stated, too much money is chasing too few deals.

Reduced client management responsibility

The open checkbooks of PE firms encourage excessive risk and over-spending by client companies. Iana Dimitrova, CEO of FinTech start-up OpenPayd, has warned, “Investors are increasingly writing higher and higher checks. Frankly, I see that as detrimental to the long-term sustainability of our industry because businesses are not focused on generating value, they’re focused on burning and deploying cash.”

Increased risk data

For firms willing to embrace enhanced investment due diligence, there is a new level of insight into risk data available. The reputation of a firm and its senior management has never been more critical. Firms don’t want to invest in businesses or individuals with bad reputations or troubled pasts.

Emphasis on ESG goals

PE firms and their investors are increasingly conscious of a prospective investment’s environmental, social, and governance goals. Elias Koronis, a partner at Hermes GPE, suggests that sustainability is now as big a factor as other risk data; “The big mindset shift is that now ESG risk is as important and as central to a company as any other type of financial risk, such as leverage risk”.

ESG Investing & Due Diligence – Q&A with Brendan Bradley

Limited analytical resources & experience

The experience and expertise necessary to analyse potential PE investment opportunities typically takes years to acquire.

Analysis of the character and backgrounds of client company management is especially critical and adding capable, experienced staff amidst current market conditions is increasingly difficult. As the workload grows for analysts and PE decision-makers, shortcuts in due diligence are inevitable.

The Importance of Due Diligence

Private equity investment is considered high risk in normal economic periods. The existing market conditions escalate the risk for investors and justify continuous emphasis on investment and reputational risk management.

Client Management Team Importance

Few investors dispute the importance of the management team in the success of a business. Private equity firms understand that the value of a company is not a “good idea,” but management’s ability to transform the idea into reality.

No matter how revolutionary the concept, the management team’s performance is critical to success.

Of the many factors that affect the investment decision, management due diligence – evaluating the quality and skill of management – is the most difficult due to its intangible nature.

Inexperienced analysts fail to recognise that search engines index only a small portion of available online information (4% to 6%), consequently omitting masses of data that could provide valuable insight about a company or its executive reputations, work histories, values, and abilities.

Under competitive pressures to quickly determine whether an investment is warranted, private equity analysts are tempted to minimise reputational risk in their due diligence, especially when a cursory search confirms their subconscious biases.

An open-source internet search – enhanced by machine learning and natural language processing – provides independent, unbiased information about the attitude and aptitude of individuals and firms, ensuring they comply with regulatory guidelines and identify potential conduct or financial crime risks.

PE Analysts Limitations

Private equity analysts are especially adept at reviewing quantitative financial and industry data necessary to confirm or modify prospective investments’ pro forma statements, valuations, and cap tables.

Unfortunately, they rarely have the search and database query skills and experience required to complete enhanced due diligence (for risk & compliance), investment (or management) due diligence, or specific functions, including ESG.

Their lack of experience can overlook indications of questionable actions – allegations of discrimination and abusive behaviour, data leaks, fraudulent behaviour, and corruption – by the potential investment candidate or its founders.

Case Study: ESG Risks Uncovered In Investigation For Global Private Equity Firm

Private Equity Risk :

Private equity investments offer substantial opportunities for growth and returns, but they are not without risks. Investors in private equity face various types of risk, including market risk, liquidity risk, and operational risk. Market risk stems from economic fluctuations and the potential for underperformance of portfolio companies. Liquidity risk arises because private equity investments are typically illiquid and require a longer investment horizon. Operational risk pertains to issues within the portfolio companies, such as mismanagement or operational challenges. Successfully navigating these risks requires thorough due diligence, diversification, and a long-term investment perspective to capitalize on the potential rewards of private equity.

Time To Know More (private equity risk)

In this hyper-competitive PE period following the pandemic, private equity risk is exceptionally high. The combination of increased client expectations and higher investment amounts forces PE firms to identify, analyse and confirm investment decisions on tighter deadlines and in a saturated market.

Simultaneously, the global increase of social activism exposes companies to new risks – with sustainability and culture at the heart of reputational vulnerabilities.

While no strategy is failsafe, a thorough and complete due diligence process, including reputation and management, can help lower overall investment risk while relieving pressure on internal resources.

For more information on lowering investment risk, schedule a call with our team here.

Tags : Private equity , Private Equity Fund, private equity risk.

New Whitepaper and Checklist

New Whitepaper and Checklist