Investment

Due Diligence

Groundbreaking due diligence investigative software Platform that reduces risk and supercharges your Investment Due Diligence processes.

Ensuring Comprehensive Risk Mitigation for Your Business.

Investment Due Diligence

Investment Due Diligence

Groundbreaking due diligence investigative software Platform that reduces risk and supercharges your investment Due Diligence processes.

Actionable Insights for Informed Decisions

with Neotas Investment Due Diligence

Protect your reputation, assets, and stakeholders with our Enhanced Due Diligence services. Enhanced Due Diligence is no longer a choice; it is a necessity in today’s high-risk business environment.

Intelligent and Investigative

Smarter decision-making by automating data filtering and analysis from internal and external sources to highlight vital information.

Analysis & Visualization

Discover links and network mapping using interactive charts, detailed data view and reporting efficiency. Deep-dive into the data to derive valuable insights.

Speed and Accuracy

Work faster and eliminate errors by accessing all data sources from Neotas Enhanced Due Diligence platform in a single dashboard.

Secure & Transparent

Maintain privacy and anonymity while conducting due diligence. Complete control on your investigations and data utilization.

Billions Of Data Sources

Analyse data from databases covering over 198m corporate records and 600bn+ archived web resources.

Don’t be limited by international jurisdictions or time sensitivities. We rapidly process data in over 200 languages.

Clear Risk Reporting, Efficiently Delivered

Receive concise, accurate findings that focus on relevant red flags only – all with zero false positives.

Analyst investigation time is reduced by a minimum of 25%.

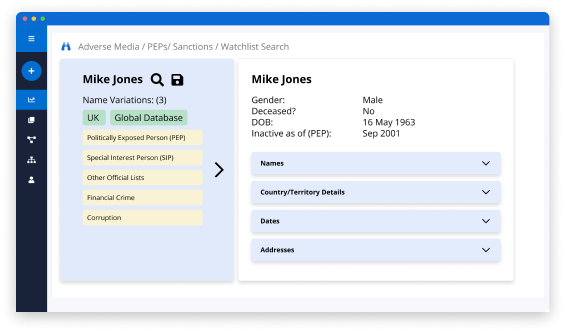

Full Coverage Including Adverse Media, PEPs, Sanctions & Watchlist Screening

We help you build a clear and concise individual risk profile.

Rapidly interrogate the largest traditional databases in the world, as well as 100% of public online data.

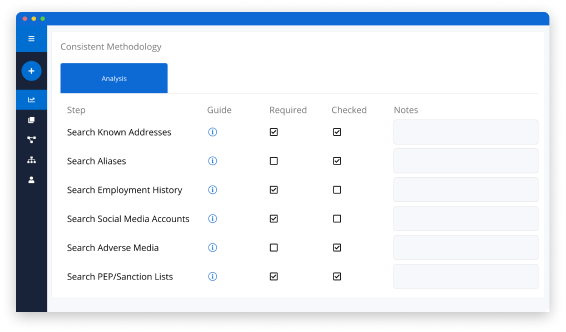

Fully Auditable Process

Ensure regulatory compliance with fully auditable processes.

Clear search history and documents saved to the case file at every step.

Results are monitored and evidenced throughout.

Protect your business with confidence using Investment Due Diligence

Neotas is trusted by leading organizations across various sectors and geographies. We have a global network of experts and analysts who can deliver timely and accurate intelligence in any jurisdiction. We adhere to the highest standards of quality, ethics and confidentiality.

Improve Efficiencies

Improve analyst efficiencies, including cost and time reduction of minimum 25% with zero false positives.

Reduce Blindspots

The FCA recommends open source Internet checks as best practice (FG 18/5). Manage and reduce risk by incorporating 100% of online sources into your processes.

Ongoing Monitoring

Manage risk with hyper accurate ongoing monitoring. We will monitor 100% of publicly available online data to help identify relevant risks.

Book A Demo

Case Studies

Our clients can choose to use our advanced technology to interrogate vast data sources using their own methodologies. Our team of in-house expert analysts can also produce reports for you.

Frequently Asked Questions

Enhanced Due Diligence (EDD) is a comprehensive process that involves conducting more thorough investigations to identify and mitigate risks associated with high-risk customers or transactions. It is an essential part of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) efforts.

EDD is required when dealing with high-risk customers, high-value transactions, politically exposed persons (PEPs), entities from high-risk countries, and transactions showing unusual patterns or suspicious activities.

Conducting EDD involves gathering additional customer information, performing in-depth risk assessments, verifying data thoroughly, continuous monitoring, and reporting suspicious activities to relevant authorities.

Enhanced Due Diligence means a more stringent and meticulous approach to assessing customer risk and transaction validity. It aims to uncover potential illicit activities and protect businesses from financial crimes.

Read more on Due Diligence.

Enhanced Customer Due Diligence (ECDD) is another term for EDD, focusing on the customer-specific aspect of the enhanced process.

Countries with higher risks of money laundering, terrorist financing, or inadequate AML regulations are considered high-risk countries, requiring businesses to apply more rigorous EDD measures for customers and transactions involving these countries.

An Enhanced Due Diligence Checklist is a structured list of requirements and steps that businesses follow to ensure the proper implementation of EDD procedures for high-risk customers and transactions.

In the context of Anti-Money Laundering (AML), Enhanced Due Diligence (EDD) refers to the additional measures taken to mitigate the risk of money laundering and terrorist financing.

In the banking sector, Enhanced Due Diligence is an essential practice to identify and manage potential risks associated with certain customers, transactions, or countries to maintain the integrity of financial systems.

Yes, the UK conducts Enhanced Due Diligence as part of its legal obligations under the Money Laundering Regulations to combat financial crimes effectively.

To carry out EDD, businesses need to follow established procedures, such as gathering additional information, risk assessment, verification, and monitoring, in compliance with AML regulations.

Yes, businesses should perform Enhanced Due Diligence on private limited entities if they fall under the category of high-risk customers, particularly when dealing with certain industries or high-value transactions.

enhanced due diligence checklist

enhanced due diligence requirements

what is enhanced due diligence

enhanced customer due diligence

enhanced due diligence aml

enhanced due diligence checklist uk

enhanced due diligence examples

enhanced due diligence is usually required for

enhanced due diligence meaning

what is enhanced due diligence uk

when is enhanced due diligence required

aml enhanced due diligence

aml enhanced due diligence requirements

coinbase enhanced due diligence

customer due diligence and enhanced due diligence

define enhanced due diligence

definition of enhanced due diligence

difference between due diligence and enhanced due diligence

enhanced client due diligence

enhanced due diligence analyst

enhanced due diligence analyst salary

enhanced due diligence attributes

enhanced due diligence banking

enhanced due diligence bsa

enhanced due diligence checklist template

enhanced due diligence checks

enhanced due diligence definition

enhanced due diligence edd

enhanced due diligence fatf

enhanced due diligence fca

enhanced due diligence for high risk customers

enhanced due diligence for peps

enhanced due diligence form

enhanced due diligence high risk customer

enhanced due diligence is required to be done when

enhanced due diligence is usually required for which customer

enhanced due diligence jobs

enhanced due diligence kyc

enhanced due diligence means you should

enhanced due diligence measures

enhanced due diligence money laundering

enhanced due diligence money laundering regulations

enhanced due diligence pep

enhanced due diligence procedures

enhanced due diligence process

enhanced due diligence questionnaire

enhanced due diligence report

enhanced due diligence report sample

enhanced due diligence software

enhanced due diligence sra

enhanced due diligence template

enhanced due diligence training

enhanced due diligence uk

examples of enhanced due diligence

fatf enhanced due diligence

how to conduct enhanced due diligence

how to perform enhanced due diligence

money laundering enhanced due diligence

pep enhanced due diligence

politically exposed person enhanced due diligence

Discover How To Connect The Dots.

Try Neotas Due Diligence Platform Today! All due diligence information at your fingertips, without the hassle! Our advanced technology delivers new insights while managing all risk data in a single centralised hub.