DBS Checks

5 Industries that Should be Doing More than a DBS Check

A Disclosure and Barring Service (DBS) check is a common way for employers to assess the background of a potential employee. Many jobs ask that employees undertake a DBS check to ensure they have a clean criminal record and will not be putting people that they work with at risk.

Industries in which employees are dealing with vulnerable people, and particularly children, however, should arguably be doing more than just a DBS check. These roles can involve positions of power and authority, and when working with vulnerable people, potential employees need to be properly vetted. While a DBS check is a good initial assessment, for certain industries it simply isn’t enough to know that an appropriate person is being hired.

What does a DBS check include?

A DBS check, formerly and often known as a CRB check, is a record of someone’s criminal record, including any convictions and cautions. There are currently four different types of DBS checks, depending on the level required from the employer:

Basic DBS check

A basic DBS check will show unspent convictions and conditional cautions on the applicant’s criminal record. If you are an individual applying for your own CRB check, this is the only one you can attain.

Standard DBS check

Most companies that require a CRB check will opt for a standard check, unless the applicant is working with vulnerable people. A standard DBS check reveals spent as well as unspent convictions, and any cautions, reprimands, or final warnings on an applicant’s criminal record.

Enhanced DBS check

This check covers all the same information as a standard DBS check, but the Disclosure and Barring Service will also contact local police for any information or encounters with the applicant they might deem appropriate to disclose.

Enhanced DBS check with barred lists

The fourth and most comprehensive check covers everything in an enhanced check plus will reveal if the candidate is on a list of people barred from working in a particular role.

What doesn’t a DBS check include?

- All DBS checks are only valid for the country in which they are taken out. If the applicant has ever lived overseas and been convicted of a crime in that country, it will not show on a UK criminal record. Each country has their own system for running criminal background checks, and the employer would need to follow the proper channels within each overseas country to run a check on an applicant who lived there. Of course, if an applicant doesn’t mention living overseas, any convictions held in another country would never be known.

- Another drawback of a CRB check is that they only cover convictions, not accused crimes. Many crimes, particularly sexual assaults, go unprosecuted. Some studies show that the prosecution rate of rape accusations are as low as 2% and sexual offences as low as 4% in England and Wales. Many of these assaults go unreported, and can be very hard to prosecute, resulting in such low figures. Someone accused but not convicted of a sexual assault will not have this show up on their criminal record or DBS check.

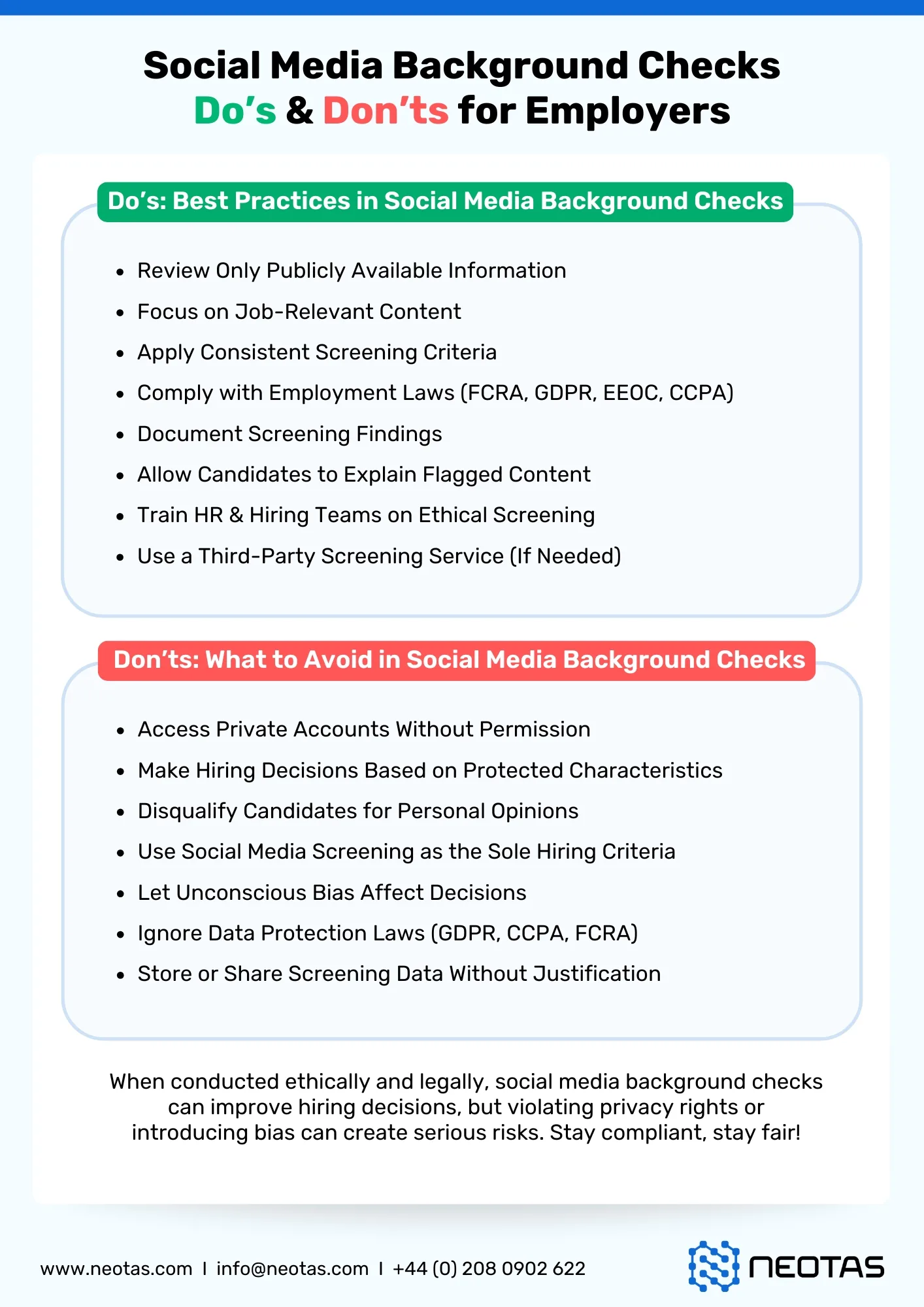

- Most activity on social media is not included in a DBS check. While social media is a personal part of an employee’s lives, there can be occasion for it to be reported to the police, particularly in the case of online hate speech rhetoric, which can result in a criminal record charge. Much online activity flies under the radar, however, and is still something to be properly considered for someone’s background check.

- A DBS check has no expiration date and is true at the time it is carried out. However, any activity post-assessment will not be included, so it’s usually requested anew for each job application.

Which industries should go further?

A DBS check is of course a good idea for many professions, particularly those that deal with young and vulnerable people. But some of these industries should be doing more than even an enhanced DBS check. The five industries below are examples of jobs in which employees are in direct contact with vulnerable people, and the potential dangers a DBS check wouldn’t protect against..

Taxi and minicab companies

Taxi and minicab companies are private firms whose employees have intimate access to their customers, as well as access behind a wheel. As a result, it is imperative to ensure not only that they are hiring competent drivers, but people with a clean criminal background with no prior inappropriate behaviour that could jeopardise the safety of the passengers. A taxi driver working for a private firm or company such as Uber or Ola should be properly vetted before customers get in a car with them. Many taxis may also be transporting people who are under the influence after a late night, making them particularly vulnerable.

Currently, not all UK taxi companies require an enhanced check for applicants, as it can depend on the council laws. Uber has famously been under attack for the 3,000 allegations of sexual assault made by passengers in 2018, as well as incidents of crashes by drivers, some of which have been fatal. Could this have turned out differently?

An enhanced DBS check will reveal any convicted crimes or warnings, but there is other inappropriate behaviour that doesn’t fall under the definition of a crime that should consider someone ineligible for the role. Their Twitter feed may be filled with pornographic content or writing sexually explicit and inappropriate comments to women online. Neither of these actions are illegal or even banned from social media sites, but should deem someone ineligible to drive women and children around. They may also have a history of posting drag racing videos online and doing tricks in their car, which is certainly not the behaviour anyone looks for in a taxi driver.

Teaching and education

Anyone who works in a school where there are children and vulnerable young adults must undergo an enhanced DBS check for obvious reasons. This includes teachers, teaching assistants, and volunteer positions.

Child safety is of the highest priority in a school, and checking the background of an applicant is important. However, as mentioned above, just because there are no convictions against a candidate does not mean there were no charges or situations. A more in-depth check into someone’s history could reveal crimes that were unable to be charged. These are particularly relevant if they involve children, sexual assault, Class A drugs, or violence. With the extremely low conviction rate for many of these crimes, DBS checks are not infallible.

Teaching applicants should also have a usual online presence in the world of social media. There have been many cases in the news of teachers getting into trouble for some of the posts online visible to the world; being overtly sexual, intoxicated, or political. Any online vitriol directed towards children should be paid particular notice, as it could indicate something more sinister.

Teachers are not encouraged to get involved in a romantic relationship with parents of the children, although it is not illegal. It’s possible a person may have left their previous teaching role due to that very reason, but would not disclose it, and would not turn up on a DBS check. Teachers and parents being involved in a romantic relationship can unfairly help or hinder a child’s progress in school, and create an uncomfortable environment.

Social care

Social care is a very broad industry that can include taking care of young people, adults, the elderly, and people with a variety of disabilities. In such cases, making sure an applicant has a clean background check is vital for them to provide the right duty of care without putting patients at risk. An enhanced CRB check is required for jobs within the social care spectrum.

Things that could put this care of duty at risk beyond a DBS check could include a family history that indicates disruption within the family. A person applying for a social care role that does not have major access to their children, for example, does not bode well. Any applicant that has a history of making jokes about disabled people is completely inappropriate. The applicant may also have undisclosed crimes that they were accused of, yet never charged for. Any history of animal abuse or neglect, such as a pet that was taken away is also an indicator that the person is not suitable for the job.

Creches and childcare facilities

Anyone looking after children outside of the education system is required to have an enhanced DBS check. Childcare can include creches, nurseries, nanny positions, playgroup leaders, and childminding, and all involve children under the age of 16, usually without the parents’ presence.

Looking after children is one of the most trustworthy positions of power, and those applying may have prior activities that make them unsuitable. A recently overturned law means that any minor youth offences, cautions, reprimands, and warnings need not be disclosed on a criminal background check. The controversial decision means that those with petty crimes in the youth are no longer discriminated against for future jobs, but could also mean that crimes relevant to a childcare position are overlooked.

Online activity, previous childcare positions and the reason for leaving, as well as family history, are all good indicators of a potential employee’s suitability to the role. An applicant may have spent time abroad teaching English as a Second Language, in which case a further background check would need to be undertaken.

Security services

Security services can cover everything from security guards at supermarkets and clubs, to bank security, university campus security, as well as protecting high ranking figures of authority. The job of a security guard or officer is to protect a person or property from damage, theft, fire, or other threats, enforce laws, and keep watch on anything suspicious or unusual.

Security guards often interact with members of the public and therefore need to have a good demeanour and approachable air. They should be able to deal with situations swiftly and calmly in the case of something getting out of hand. Sometimes physical force or detainment is necessary when there is criminal activity suspected.

Because of the physical nature of a security guard’s job, a key thing to look out for is often a history of violence or violent behaviour. While this may not show up on a DBS check, the applicant may have an uncharged accusation, a family dispute, aggressive online behaviour, or a history of threatening people. This behaviour might be missing from their background check, but a well known trait about them. If they are often sharing videos containing violence or fighting online, this could be an indication that the aspect of the job they are looking for is the physical one. An overly aggressive person is not suitable for a job as a security guard, and could be a liability for the company.

These are just a few of the positions that should be doing more than a DBS check. This can apply to a number of jobs that work with children or vulnerable people, who are the most at risk. DBS checks are not foolproof, and do not cover a person’s background as extensively as they should within certain roles.

Request a basic DBS check

Apply for a basic criminal record check to understand an individual’s unspent convictions and conditional cautions. Ideal for roles involving minimal contact with vulnerable groups.

Check someone’s criminal record as an employer

- Get a basic DBS check for an employee – Verify potential new hires by requesting a basic Disclosure and Barring Service (DBS) check, revealing any unspent convictions or cautions that may impact their suitability for the role.

- Get a standard or enhanced DBS check for an employee – Ensure a comprehensive background screening for roles involving substantial responsibility or work with vulnerable groups. Submit an application for a standard or enhanced DBS check to assess an individual’s full criminal history, including spent and unspent convictions, cautions, and relevant non-conviction information.

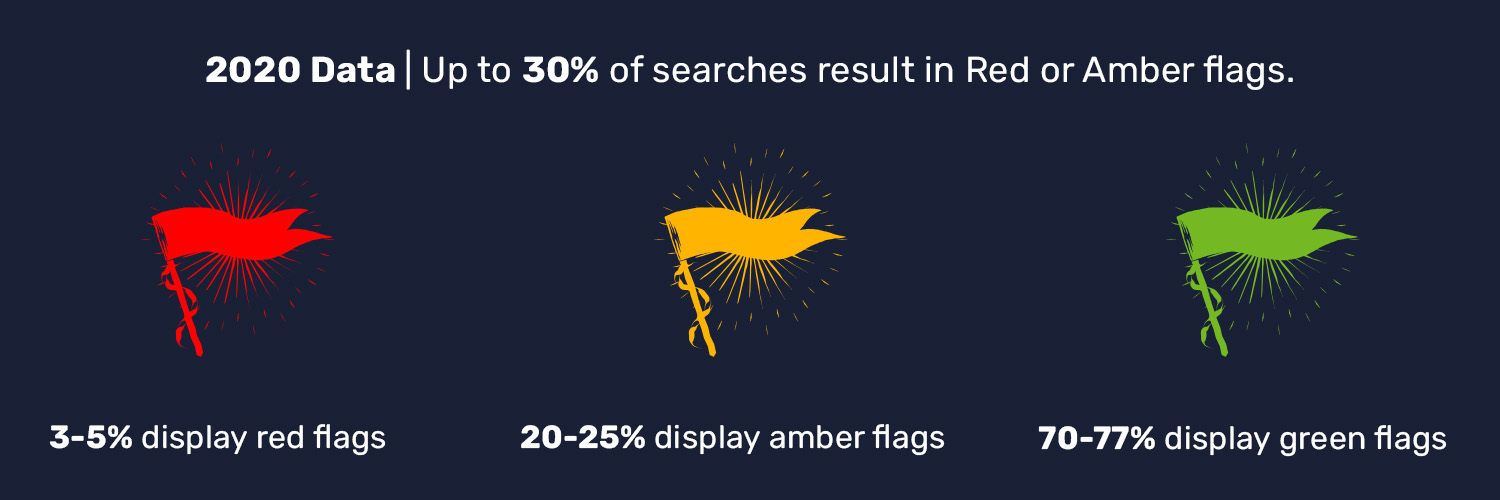

Neotas provides rigorous background screening that assesses candidates’ online behaviour. This goes far beyond an enhanced DBS check, screening all social media and online behaviour for activity that contains violence, terrorism, sexism, and racism. Get in touch to find out how we can better protect your business from potential risk from unsafe candidates. FAQs on DBS Checks:

What is a DBS check?

A DBS (Disclosure and Barring Service) check is a process that helps employers make informed decisions about hiring by providing information about a person’s criminal record. It involves searching an individual’s criminal history to ensure they are suitable for certain roles, particularly those involving work with vulnerable groups.

How long do DBS checks take?

The processing time for a DBS check can vary. On average, a standard check may take around 2 to 4 weeks. However, this timeframe can be affected by factors such as the level of check (standard, enhanced), the accuracy of the information provided, and the current workload of the DBS.

How long does an enhanced DBS check take?

Similar to standard checks, the processing time for an enhanced DBS check can vary. On average, it may take around 2 to 4 weeks. However, factors like the completeness of information and the current workload of the DBS can influence this timeframe.

Can I apply for a DBS check online?

Yes, you can apply for a DBS check online. The online application process provides a convenient and efficient way to submit the necessary information and receive the results electronically.

What is an enhanced DBS check?

An enhanced DBS check is a thorough background check that includes information about an individual’s criminal record, as well as any additional information deemed relevant by the police or other authorities. It is typically required for positions involving significant responsibility or work with vulnerable individuals.

Can I perform an enhanced DBS check online?

Yes, you can apply for an enhanced DBS check online. The online application process allows for the submission of relevant information, making it a convenient option for many individuals and organizations.

How does an enhanced DBS check differ from a standard one?

An enhanced DBS check provides more comprehensive information compared to a standard check. It includes details about an individual’s criminal history, as well as any additional information considered relevant. This level of check is typically required for roles involving higher responsibility or work with vulnerable groups, whereas a standard check provides basic criminal record information.

What is checked with a DBS check?

A DBS (Disclosure and Barring Service) check involves a comprehensive search of an individual’s criminal record history. This includes any convictions, cautions, reprimands, and warnings held on the Police National Computer. Additionally, an enhanced DBS check may include relevant information from local police forces and other authorized bodies, such as details of ongoing investigations or any other pertinent information that may impact the individual’s suitability for the role.

How far back does a DBS check go?

A DBS check provides a comprehensive overview of an individual’s criminal record history, including both spent and unspent convictions, cautions, reprimands, and warnings. The timeframe covered by the check is unlimited, meaning it can potentially reveal relevant offenses from any point in the applicant’s past, regardless of how long ago they occurred.

Can I do a DBS check on myself?

Yes, individuals can apply for a basic DBS check on themselves. This type of check provides a snapshot of an individual’s unspent convictions and conditional cautions held on the Police National Computer. However, for roles involving work with children or vulnerable adults, an enhanced DBS check is typically required, which necessitates the involvement of an employer or an authorized organization.

What do you need to pass a DBS check?

To successfully pass a DBS check, individuals must not have any relevant criminal convictions or cautions that would deem them unsuitable for the role they are applying for. The decision to proceed with an applicant’s employment is ultimately at the discretion of the employer, who will assess the DBS check results in the context of the specific job requirements and responsibilities.

What will fail a DBS check?

A DBS check may be failed if an individual has certain criminal convictions or cautions that are deemed incompatible with the role they are applying for. The nature and severity of the offenses, as well as the potential risks associated with the job, will be considered by the employer. Additionally, providing false or incomplete information during the DBS application process can also result in a failed check.

Does your criminal record clear after 7 years in the UK?

No, criminal records in the UK do not automatically clear after a specific period of time, such as 7 years. Once an individual has a criminal conviction or caution on their record, it remains there indefinitely unless specific circumstances apply, such as receiving a pardon or the conviction being overturned on appeal.

How long do crimes stay on DBS?

Criminal convictions and cautions remain on an individual’s DBS record indefinitely, regardless of the time that has elapsed since the offense occurred. This information is retained to ensure employers have access to a comprehensive overview of an applicant’s criminal history when making hiring decisions, particularly for roles involving work with vulnerable groups.

Do arrests show up on DBS?

Arrests, by themselves, do not typically show up on a DBS check. However, if an arrest led to a conviction or caution, those offenses will be included in the DBS record. Additionally, for enhanced DBS checks, relevant information from local police forces may be disclosed, which could include details about arrests or ongoing investigations, even if they did not result in a conviction.

What convictions are not protected?

In the context of DBS checks, certain convictions are not subject to filtering or protection rules, meaning they will always be disclosed on a DBS certificate. These include offenses related to violence, sexual offenses, safeguarding offenses, and any offenses committed against children or vulnerable adults. Employers may consider these unprotected convictions as relevant when assessing an applicant’s suitability for a role.

What offences are never filtered from DBS?

Certain offenses are considered so serious that they are never filtered or removed from DBS certificates, regardless of the time that has elapsed since the conviction. These offenses include, but are not limited to, murder, manslaughter, rape, sexual offenses involving children, kidnapping, and offenses related to terrorism. These convictions will always be disclosed to employers, as they are deemed highly relevant to safeguarding and public protection considerations.

How much does a DBS check cost?

The cost of a DBS check can vary depending on the level of check required and the organization conducting the check. As of January 2023, the Disclosure and Barring Service charges £23 for a basic DBS check and £40 for an enhanced DBS check. Additionally, some organizations may charge an additional administration fee to cover their operational costs.

How much does a basic DBS check cost?

As of January 2023, the Disclosure and Barring Service charges £23 for a basic DBS check. This type of check reveals any unspent convictions and conditional cautions held on the Police National Computer. It is important to note that some organizations may charge an additional administration fee on top of the DBS fee.

Can I start work before the DBS check is completed?

In some cases, employers may allow individuals to start work before their DBS check is completed, provided that appropriate risk assessments and safeguarding measures are in place. However, this decision is at the discretion of the employer and is typically dependent on the nature of the role and the level of risk involved. For positions involving work with vulnerable groups, it is generally recommended to have the DBS check completed before starting employment.

Can a job offer be withdrawn due to a DBS check?

Yes, a job offer can be withdrawn or rescinded if the results of a DBS check reveal information that the employer deems incompatible with the role or raises concerns about the applicant’s suitability. Employers have the right to make informed decisions based on the information obtained through the DBS check, taking into account the specific requirements and responsibilities of the position.

Can my employer see my DBS online?

No, employers cannot directly access an individual’s DBS check results online. The Disclosure and Barring Service provides the DBS certificate to the applicant, who must then share the results with their employer. Employers can, however, track the progress of the DBS application through an online system, but they do not have direct access to the results.

Does a DBS expire after 3 years?

No, DBS certificates do not have an expiration date. Once issued, a DBS certificate remains valid unless there is a change in the individual’s criminal record. However, some organizations may have policies that require employees or volunteers to renew their DBS checks periodically, typically every 3 years, to ensure they have the most up-to-date information about an individual’s criminal history.

What offences are never filtered from DBS?

As mentioned earlier, certain offenses are considered so serious that they are never filtered or removed from DBS certificates, regardless of the time that has elapsed since the conviction. These offenses include, but are not limited to, murder, manslaughter, rape, sexual offenses involving children, kidnapping, and offenses related to terrorism. These convictions will always be disclosed to employers, as they are deemed highly relevant to safeguarding and public protection considerations.

What convictions are not protected?

In the context of DBS checks, certain convictions are not subject to filtering or protection rules, meaning they will always be disclosed on a DBS certificate. These include offenses related to violence, sexual offenses, safeguarding offenses, and any offenses committed against children or vulnerable adults. Employers may consider these unprotected convictions as relevant when assessing an applicant’s suitability for a role.

What convictions are never spent?

In the UK, there are certain convictions that are never considered “spent” under the Rehabilitation of Offenders Act. These include serious offenses such as murder, manslaughter, rape, and offenses related to terrorism. Convictions that are never spent will always be disclosed on a DBS certificate, regardless of the time that has elapsed since the offense occurred.

Do arrests show up on DBS?

Arrests, by themselves, do not typically show up on a DBS check. However, if an arrest led to a conviction or caution, those offenses will be included in the DBS record. Additionally, for enhanced DBS checks, relevant information from local police forces may be disclosed, which could include details about arrests or ongoing investigations, even if they did not result in a conviction.

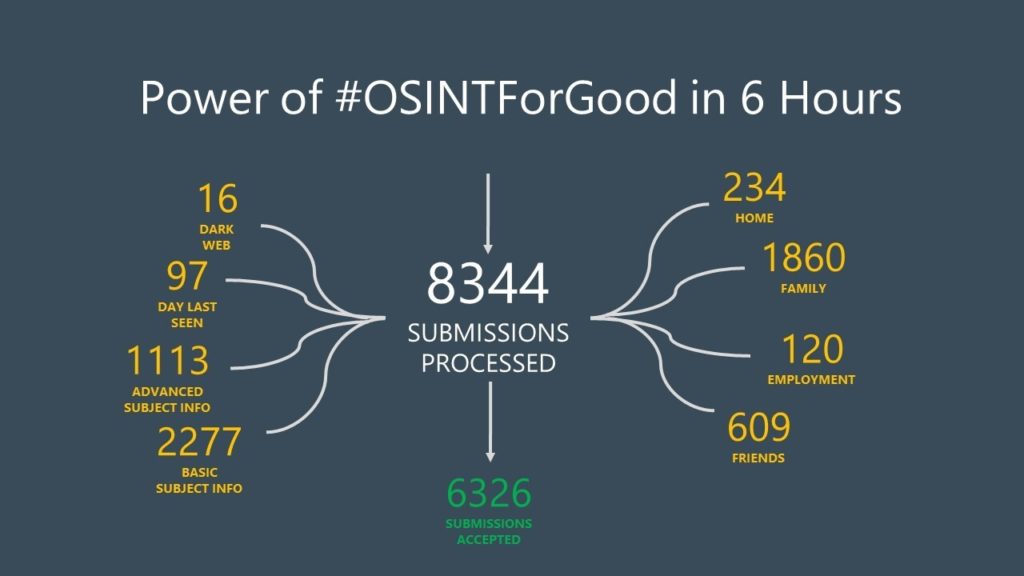

Neotas Social Media Check and Social Media Screening

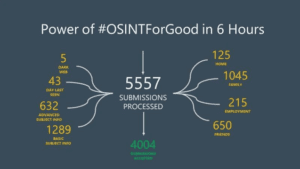

At Neotas, We understand the importance of conducting thorough and compliant Social Media Screening Checks, and our team of experts is dedicated to ensuring that the process is safe and reliable. Receive accurate and up-to-date information while complying with all relevant regulations, including GDPR and FCRA. Our advanced OSINT technology and human intelligence allow us to uncover valuable insights that traditional checks may miss.

We highlight behavioural risks identified across social media profiles and the wider internet. Supplements the background screening process. Learn more about how we can help you conduct social media screening and background checks in a safe and compliant manner.

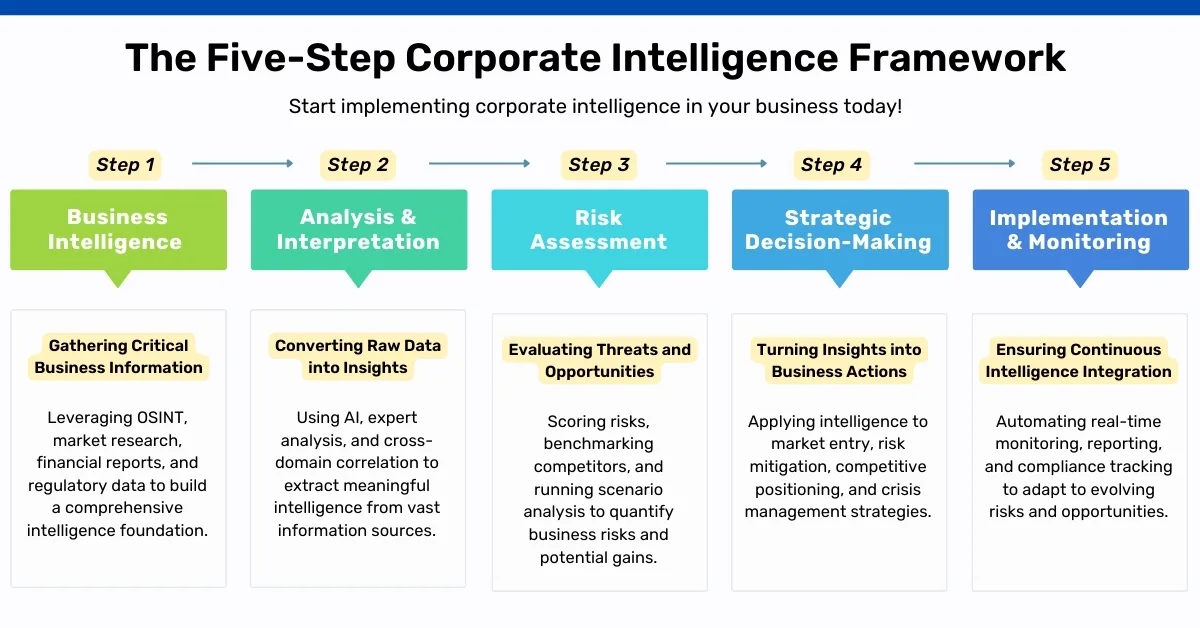

Economic Forecasting – Analysing global financial trends to prepare for inflation, interest rate changes, and recessions.

Economic Forecasting – Analysing global financial trends to prepare for inflation, interest rate changes, and recessions. Regulatory Trend Analysis – Monitoring upcoming laws and regulations to adjust compliance frameworks.

Regulatory Trend Analysis – Monitoring upcoming laws and regulations to adjust compliance frameworks. Geopolitical Risk Assessments – Identifying supply chain risks caused by international trade restrictions, political instability, or sanctions.

Geopolitical Risk Assessments – Identifying supply chain risks caused by international trade restrictions, political instability, or sanctions. Competitive Benchmarking – Studying market trends to refine pricing strategies and product development.

Competitive Benchmarking – Studying market trends to refine pricing strategies and product development. Identifying risks before they escalate.

Identifying risks before they escalate.

Pre-Onboarding Due Diligence – Corporate intelligence teams conduct background checks on potential third-party vendors to verify their financial stability, legal history, ethical practices, and security posture.

Pre-Onboarding Due Diligence – Corporate intelligence teams conduct background checks on potential third-party vendors to verify their financial stability, legal history, ethical practices, and security posture.