Anti-Money Laundering (AML)

Comprehensive Guide to Anti-Money Laundering (AML) & Combating the Financing of Terrorism (CFT) – Dive into AML compliance, KYC procedures, transaction monitoring, AML laws, regulations, and risk assessments. Discover actionable strategies for banking, finance, estate agents, and more to prevent money laundering

Key Takeaways from this article:

- Explore AML regulations and laws.

- Implement effective AML compliance programs.

- Monitor transactions to detect suspicious activities.

- Enhance KYC processes and customer due diligence.

- Assess risks and mitigate potential money laundering threats.

- Integrate AML and CFT strategies to ensure compliance.

- Leverage technology for advanced AML monitoring.

- Develop risk-based approaches to AML compliance.

- Stay updated with global AML trends and challenges.

- Ensure regulatory compliance across all financial sectors.

What is Anti-Money Laundering (AML)?

Money laundering is a global issue that threatens the integrity of financial systems and fuels criminal activities. Anti-Money Laundering (AML) encompasses the laws, regulations, and processes put in place to prevent criminals from disguising illegally obtained funds as legitimate income. The primary objective of AML frameworks is to detect, deter, and report activities related to money laundering, protecting the financial system from being exploited by illicit activities.

Anti-Money Laundering refers to a set of laws, regulations, and procedures aimed at preventing criminals from concealing illicit funds obtained from activities such as drug trafficking, tax evasion, fraud, terrorism, and other financial crimes.

AML policies focus on identifying and stopping the flow of “dirty money” by obligating financial institutions, businesses, and professionals to implement strict measures to track and report suspicious activities.

The essence of AML is to ensure that financial systems are not manipulated for illegal gains. At its core, AML relies on transaction monitoring, reporting suspicious transactions, and conducting due diligence on customers, all to detect anomalies that could indicate money laundering.

History and Evolution of AML

AML regulations have developed significantly over the past decades. The origins of modern AML frameworks can be traced back to the 1970s when the United States enacted the Bank Secrecy Act (BSA) in 1970. The BSA was among the first laws designed to combat money laundering, requiring financial institutions to report certain transactions that could be linked to illicit activities.

The landscape of AML regulation changed dramatically in the wake of the 9/11 attacks. The need to curb terrorist financing (CFT – Combating the Financing of Terrorism) led to stricter laws and an emphasis on international cooperation. This resulted in landmark developments like the USA PATRIOT Act and the tightening of global regulations.

The Financial Action Task Force (FATF), an intergovernmental organisation established in 1989, has played a pivotal role in shaping AML policies. FATF’s 40 Recommendations have become the global benchmark for AML compliance, influencing national and international standards. Over time, AML regulations have expanded to cover not just traditional financial institutions but also industries such as real estate, casinos, and virtual currencies.

Today, AML continues to evolve with the advent of new technologies, emerging financial products, and cross-border transactions, making it a constantly adapting field.

Importance of AML in the Global Economy

AML is vital to the stability and security of the global financial system. Without effective AML frameworks, criminals and terrorist organisations can exploit gaps in financial regulations to launder funds, finance illegal operations, and undermine the rule of law.

In the global economy, money laundering poses several risks:

- Financial Instability: Unchecked money laundering can distort markets by allowing illegal funds to be injected into legitimate financial systems, potentially destabilising economies.

- Reputation Risk: Financial institutions involved in money laundering activities face significant reputational damage, leading to loss of customer trust and reduced investor confidence.

- Legal and Regulatory Risks: Failure to comply with AML regulations can lead to hefty fines, legal penalties, and even sanctions on countries that fail to meet international AML standards.

- Terrorism Financing: An essential component of AML is combating the financing of terrorism (CFT), which ensures that illicit funds are not used to support terrorist organisations.

AML is not only about preventing crime; it is about maintaining a transparent and stable global financial system.

Key Definitions: AML, CFT, Financial Crime, and Money Laundering

To understand AML comprehensively, it is essential to grasp key definitions:

- Anti-Money Laundering (AML): A framework of laws and regulations designed to prevent the practice of generating income through illegal actions.

- Combating the Financing of Terrorism (CFT): Measures aimed at preventing and detecting the flow of funds intended for terrorist activities.

- Financial Crime: Any non-violent crime that results in the unlawful gain of money, including fraud, bribery, tax evasion, and money laundering.

- Money Laundering: The process by which criminals disguise the original ownership and control of the proceeds of criminal activity by making such proceeds appear to have come from a legitimate source.

Understanding these definitions is crucial for grasping how AML functions and why it matters in the global context.

Types of Money Laundering

There are several ways money can be laundered, including but not limited to:

- Bank Money Laundering: Where criminals use banks to deposit or transfer illicit funds.

- Trade-Based Money Laundering: Involves misrepresenting the price, quantity, or quality of goods to disguise illicit funds through legitimate trade channels.

- Real Estate Money Laundering: Illicit funds are used to buy property, which is later sold to “clean” the money.

- Cryptocurrency Laundering: With the rise of digital currencies, criminals now use anonymous transactions via cryptocurrencies to launder money, making it harder to trace.

- Cash Smuggling: Physically moving large sums of cash across borders to avoid detection and reporting requirements.

These types reflect the need for a multi-faceted approach to AML, where regulations, transaction monitoring, and enforcement mechanisms adapt to the evolving methods of laundering money.

Impact of Money Laundering on the Economy and Society

Money laundering has wide-reaching implications on both the economy and society:

- Economic Instability: Money laundering can distort financial markets, leading to misallocation of resources. It can artificially inflate real estate prices, create business monopolies, and interfere with legitimate competition.

- Loss of Tax Revenue: Governments lose significant tax revenue from undeclared and illegal funds being laundered, which can affect public spending on healthcare, education, and infrastructure.

- Social Harm: Money laundering enables and perpetuates criminal activities such as drug trafficking, terrorism, human trafficking, and corruption. The social cost of such crimes is immense, eroding the rule of law and undermining governance.

- Weakened Institutions: Widespread money laundering can undermine the trust in financial institutions and public bodies, creating a perception of corruption and eroding investor confidence in the affected regions.

The fight against money laundering is essential for safeguarding the integrity of financial systems, maintaining economic stability, and reducing the social harm caused by criminal activities. AML frameworks must continuously adapt to new risks, technologies, and methods used by criminals to remain effective.

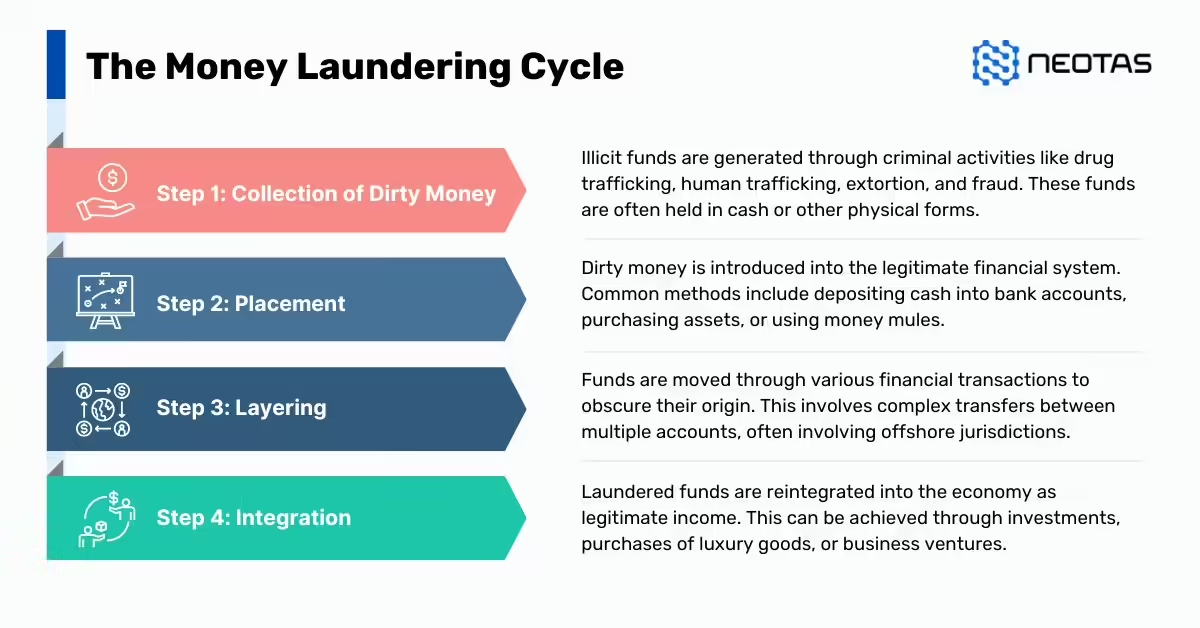

Money Laundering Process

Money laundering is a criminal act where illicit funds are processed through various layers to make them appear legitimate. Understanding the stages and processes involved in money laundering is critical to implementing effective Anti-Money Laundering (AML) controls. The process of money laundering generally follows three main stages: Placement, Layering, and Integration.

Stages of Money Laundering

Placement

The placement stage is the initial step where the illicit money is introduced into the financial system. At this stage, the money launderer attempts to distance themselves from the proceeds of crime by moving the funds from direct association with the illegal activity. Common methods include depositing large sums of cash into bank accounts, purchasing high-value assets such as real estate or luxury goods, or gambling at casinos.

Examples of Placement:

- Structuring, or “smurfing,” involves depositing small amounts of money below regulatory reporting thresholds to avoid detection.

- Purchasing goods that are easily resellable, such as cars or jewellery, allows criminals to integrate illicit funds into the economy.

Risks: This stage is risky for criminals because financial institutions are often required to report suspicious or large cash deposits, making the placement of illegal funds potentially detectable.Layering

The second stage is layering, which seeks to obscure the origins of the money by conducting complex transactions that make tracing the illegal funds difficult. In this stage, the launderer uses various techniques to create multiple financial transactions, moving the funds between accounts, institutions, or even countries. The aim is to confuse investigators by creating a complex trail that disconnects the money from its original source.

Examples of Layering:

- Transferring money between different bank accounts in various jurisdictions (particularly in countries with lax AML laws) can make tracking the money challenging.

- Using shell companies to make financial transactions, making it harder to trace the ownership of assets.

Risks: Modern AML systems employ sophisticated technology and algorithms to detect unusual transaction patterns, making it harder to succeed in this phase without detection.Integration

The final stage of money laundering is integration, where the illicit funds are fully absorbed into the legal economy and appear to come from legitimate sources. The launderer may use the cleaned money to invest in businesses, real estate, or other lawful ventures. Once the money is integrated into the economy, it becomes extremely difficult to distinguish it from legitimate earnings.

Examples of Integration:

- Investing in property development, where illicit funds are used to finance construction or purchase buildings.

- Establishing businesses where the laundered money can be co-mingled with legitimate revenue.

Risks: Once the funds reach this stage, it is often too late to track their illegal origin without clear evidence from the earlier stages. Stronger integration controls are essential to detect illicit gains before reaching this phase.

Examples of Money Laundering

Money laundering techniques are continually evolving, and criminals are becoming more sophisticated in their approach. Some common examples of money laundering include:

- Bank Money Laundering: Criminals deposit small amounts of cash across multiple accounts, often referred to as “structuring,” to avoid triggering AML alerts.

- Trade-Based Money Laundering (TBML): This involves manipulating trade transactions by over-invoicing or under-invoicing goods and services to launder money across borders.

- Casino Laundering: Criminals buy casino chips with illicit cash, gamble lightly, and cash out with “clean” winnings.

- Real Estate Money Laundering: Illicit funds are used to purchase properties, which are later sold, creating a legitimate-looking transaction.

Emerging Trends in Money Laundering

With technological advancements and the globalisation of financial markets, new trends in money laundering have emerged. These trends pose unique challenges for AML frameworks and regulatory bodies.

Cryptocurrency and Digital Currency Laundering

Cryptocurrencies, like Bitcoin and Ethereum, have gained popularity for their anonymity and decentralised nature, making them attractive to money launderers. Criminals use cryptocurrency exchanges, peer-to-peer transactions, and decentralised finance (DeFi) platforms to move and conceal funds. The rise of cryptocurrency mixing services and “privacy coins” further complicates the tracking of illicit money flows.

Trade-Based Money Laundering (TBML)

Trade-based money laundering exploits international trade systems by misrepresenting the value, quantity, or quality of goods. It is one of the more complex methods of money laundering, as it involves manipulating trade invoices and cross-border transactions to disguise illegal funds as legitimate revenue. TBML poses significant challenges for customs and financial institutions because it requires deep knowledge of trade operations.

Virtual Assets and Blockchain Technology

The increasing use of virtual assets such as Non-Fungible Tokens (NFTs) and the broader adoption of blockchain technology introduces new avenues for money laundering. Blockchain offers transparency through immutable ledgers, but the anonymity provided by some platforms makes it difficult to trace the origin of funds. Regulatory bodies are still working to catch up with these technologies, implementing frameworks to govern the use of virtual assets in financial transactions.

AML Regulations & Legal Framework

A strong regulatory framework is critical for enforcing AML controls and ensuring compliance with international standards. Various global bodies and country-specific regulations have been established to combat money laundering and terrorist financing.

Global AML Regulatory Bodies

Financial Action Task Force (FATF)

The Financial Action Task Force (FATF) is an intergovernmental organisation that develops international policies to combat money laundering and terrorist financing. FATF issues guidelines known as the “40 Recommendations” that countries are encouraged to implement in their national legal frameworks. FATF evaluations (known as mutual evaluations) assess how well jurisdictions comply with these standards.

European Union AML Directives (EU AMLD)

The EU has implemented several Anti-Money Laundering Directives (AMLD) over the years, with the 5th and 6th AML Directives providing significant updates. These directives impose stricter regulations on virtual assets, beneficial ownership registers, and cross-border information sharing. The EU directives are binding on all member states and ensure a unified approach to tackling money laundering.

Basel Committee on Banking Supervision (BCBS)

The Basel Committee develops global standards for banking regulation, including AML-related requirements. It works closely with the FATF to align banking practices with AML and CFT regulations and promotes the effective implementation of risk-based frameworks.

AML Regulations by Country/Region

AML Regulations UK

In the UK, AML regulations are governed by the Proceeds of Crime Act 2002 and subsequent updates, including the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017. The UK also follows the FATF recommendations and EU AML directives.

AML Regulations US

In the US, the primary AML laws are the Bank Secrecy Act (BSA) and the USA PATRIOT Act, which require financial institutions to implement AML programmes, report suspicious activities, and conduct customer due diligence (CDD). The Financial Crimes Enforcement Network (FinCEN) oversees compliance.

AML Regulations EU

The EU has developed a robust AML framework through its directives, which member states must incorporate into national law. The 5th AMLD focused on enhanced due diligence for politically exposed persons (PEPs) and virtual assets, while the 6th AMLD introduced criminal liability for money laundering offences.

AML/CFT Compliance Requirements

AML/CFT compliance involves adhering to a range of regulations designed to detect and prevent financial crimes. Key requirements include:

- Customer Due Diligence (CDD): Verifying the identity of customers and understanding the nature of their business.

- Transaction Monitoring: Monitoring customer transactions for suspicious behaviour.

- Suspicious Activity Reporting (SAR): Filing reports with the relevant authorities when suspicious activity is detected.

AML Legislation & Laws

UK Proceeds of Crime Act

The UK’s Proceeds of Crime Act criminalises money laundering and provides powers for asset seizure and confiscation of criminal proceeds.

US Patriot Act & Bank Secrecy Act

The US Patriot Act expanded the requirements of the Bank Secrecy Act to include stricter due diligence and monitoring of financial transactions linked to terrorism.

EU 5th and 6th AML Directives

These directives are central to the EU’s AML/CFT legal framework, focusing on transparency, criminal liability, and virtual assets regulation.

AML Laws for Banks & Financial Institutions

Financial institutions must comply with strict AML laws to monitor transactions, conduct customer due diligence, and report suspicious activities to national regulators.

AML Laws for Estate Agents and Other Industries

Non-financial sectors such as real estate and high-value goods traders must also comply with AML laws. Estate agents, in particular, are required to verify the identity of buyers and sellers and report suspicious transactions.

AML Compliance Framework

An effective AML compliance framework is essential for preventing and detecting money laundering. This framework encompasses policies, procedures, and controls designed to ensure that businesses comply with AML regulations.

What is AML Compliance?

AML compliance refers to the processes and systems that businesses implement to meet legal and regulatory requirements in relation to preventing, detecting, and reporting money laundering activities. It includes identifying suspicious activity, conducting due diligence on customers, and ensuring proper transaction monitoring.

AML Compliance Checklist

An AML compliance checklist helps ensure that organisations meet all regulatory requirements. Key items include:

Note: This is a general checklist and may not cover all specific requirements for your jurisdiction or industry. It’s essential to consult with legal and compliance experts to ensure full compliance.

Customer Due Diligence (CDD)

- Identification: Verify customer identity using reliable documents (e.g., passport, driver’s license).

- Enhanced Due Diligence (EDD): Conduct additional checks for high-risk customers (e.g., politically exposed persons, high-value transactions).

- Beneficial Ownership: Identify and verify the ultimate beneficial owner(s) of the customer.

- Sanctions Screening: Regularly screen customers and their associated entities against sanctions lists.

Transaction Monitoring

- Suspicious Activity Reporting (SAR): Establish procedures for identifying and reporting suspicious transactions to relevant authorities.

- Unusual Activity: Monitor for unusual patterns or large transactions that deviate from the customer’s typical behavior.

- High-Risk Activities: Be aware of high-risk activities (e.g., cash-intensive businesses, cross-border transactions).

Recordkeeping

- Retention: Maintain accurate records of customer identification, transactions, and other relevant information for a specified period.

- Accessibility: Ensure easy access to records for audits, investigations, and regulatory inquiries.

Training and Education

- Staff Training: Provide regular training to staff on AML regulations, procedures, and red flags.

- Awareness: Promote AML awareness throughout the organization.

Risk Assessment

- Identification: Identify and assess the organization’s risk profile for money laundering and terrorist financing.

- Mitigation: Implement measures to mitigate identified risks.

Independent Testing

- Regular Reviews: Conduct periodic independent reviews of the AML program to ensure its effectiveness.

- Corrective Actions: Address any deficiencies identified during reviews.

Governance and Oversight

- AML Officer: Appoint a dedicated AML officer responsible for overseeing compliance.

- Board Oversight: Ensure that the board of directors is informed about AML risks and the effectiveness of the program.

Specific Industry Considerations

- Financial Institutions: Adhere to banking regulations and guidance.

- Casinos and Gaming: Implement measures to prevent money laundering through gaming activities.

- Real Estate: Conduct due diligence on property transactions and monitor for suspicious activity.

- Virtual Asset Service Providers (VASPs): Comply with regulations specific to cryptocurrency and digital assets.

Remember to:

- Stay updated on regulatory changes and industry best practices.

- Regularly review and update your AML program to address evolving risks.

- Maintain a culture of compliance within your organization.

AML Compliance Programme Development

Developing an AML compliance programme requires a structured approach tailored to the unique risks faced by an organisation. The programme should be robust, risk-based, and integrated into the organisation’s overall governance and risk management frameworks. Key elements of an AML compliance programme include:

Risk-Based Approach (RBA): This is a cornerstone of an effective AML programme. Organisations must assess the risk levels of their clients, products, services, and geographic locations to focus resources on higher-risk areas. This ensures that efforts are concentrated where the risk of money laundering is greatest.

Policies and Procedures: Clear AML policies and procedures should be documented, setting out the organisation’s approach to preventing money laundering and the roles of staff members. These policies must be reviewed and updated regularly to ensure compliance with changing regulations and risks.

AML Governance & Senior Management Roles: Senior management plays a critical role in overseeing the AML compliance framework. They must ensure that appropriate resources are allocated to the programme and that governance structures, such as compliance committees or boards, are in place to oversee its effectiveness.

Staff Training & Awareness: Continuous training for employees is essential to ensure that staff can identify red flags and suspicious activities. Training should be tailored to different roles within the organisation, and regular updates must be provided to ensure awareness of emerging risks and new regulations.

AML Compliance in Banking

Banks are on the front line of the fight against money laundering. Given the scale and complexity of their operations, banks face higher AML risks and must implement stringent controls. Key components of AML compliance for banks include:

Transaction Monitoring: Banks must use sophisticated software systems to monitor customer transactions for unusual activity. This includes setting rules to flag potential money laundering indicators, such as large cash deposits, frequent international transfers, or transactions inconsistent with a customer’s profile.

Know Your Customer (KYC) Requirements: KYC is a critical component of AML compliance. Banks must collect and verify information about their customers, such as identification documents, source of funds, and the nature of the customer’s business. Enhanced due diligence is required for high-risk customers, including politically exposed persons (PEPs).

Suspicious Activity Reports (SARs): When a bank identifies potentially suspicious transactions, it is required to file a SAR with the relevant authorities. This report should be filed without tipping off the customer, and it plays a critical role in enabling authorities to investigate and prevent financial crimes.

AML Compliance for Non-Banking Sectors

AML compliance is not limited to banks; other sectors also face AML obligations, depending on the nature of their business and exposure to financial crime risks.

AML for Estate Agents

In the UK and many other countries, estate agents are required to comply with AML regulations due to the risk of criminals using real estate transactions to launder illicit funds. Estate agents must:

- Conduct customer due diligence (CDD) for both buyers and sellers.

- Report any suspicious activity related to property purchases, especially when involving cash transactions or complex ownership structures.

- Maintain records of all AML checks for a specific period as required by law.

AML for Fintechs

The rapid growth of financial technology (fintech) companies has introduced new AML risks, particularly due to the digital nature of their services. Fintech firms must comply with the same AML regulations as traditional financial institutions, including KYC checks, transaction monitoring, and filing SARs. Given their reliance on digital platforms, fintech companies often employ advanced technology like artificial intelligence and machine learning to detect money laundering risks in real time.

AML and CFT Integration

AML and CFT (Combating the Financing of Terrorism) are often discussed together, as both involve efforts to prevent the use of the financial system for criminal purposes. While AML focuses on the proceeds of criminal activities, CFT deals specifically with the prevention of terrorism financing. Integrating AML and CFT efforts ensures a comprehensive approach to financial crime prevention.

Differences Between AML and CFT

- AML (Anti-Money Laundering): Focuses on detecting and preventing money laundering, which involves the illegal process of making proceeds from criminal activities appear legitimate.

- CFT (Combating the Financing of Terrorism): Aims to prevent funds from being used to finance terrorist activities. This may include legitimate funds being used for illegal purposes, as well as illicit money flows.

Both AML and CFT frameworks rely on robust regulatory oversight, customer due diligence, and ongoing transaction monitoring to identify suspicious activity.

| Aspect | Anti-Money Laundering (AML) | Counter Financing of Terrorism (CFT) |

| Definition | Measures to prevent the conversion of illegally obtained money into legitimate assets. | Measures to prevent the financing of terrorist activities. |

| Objective | To identify and report suspicious transactions that may involve the proceeds of crime. | To identify and disrupt the flow of funds to terrorist organisations and activities. |

| Focus | Primarily focuses on financial crimes such as fraud, drug trafficking, and corruption. | Primarily focuses on activities related to terrorism and extremist groups. |

| Regulatory Framework | Governed by laws and regulations that require financial institutions to implement AML measures. | Governed by laws and regulations specifically addressing the financing of terrorism. |

| Risk Assessment | Evaluates risks associated with potential money laundering activities and customer profiles. | Assesses risks related to the potential funding of terrorism and associated entities. |

| Key Activities | – Customer Due Diligence (CDD) – Transaction Monitoring – Reporting Suspicious Activity | – Customer Due Diligence (CDD) – Monitoring for transactions related to high-risk individuals and organisations – Reporting suspicious activities that may indicate terrorist financing |

| Enforcement Agencies | Generally enforced by financial regulatory bodies such as the Financial Conduct Authority (FCA) in the UK. | Enforced by agencies focused on national security and counter-terrorism, such as the National Crime Agency (NCA) in the UK. |

| International Standards | Follows recommendations from the Financial Action Task Force (FATF) related to money laundering. | Also follows FATF recommendations but with a specific focus on preventing terrorist financing. |

| Penalties for Non-Compliance | Financial institutions may face hefty fines, loss of business, and reputational damage. | Similar penalties as AML, but with a greater emphasis on national security implications. |

Key Components of an AML Compliance Programme

- Risk-Based Approach (RBA): Prioritising resources based on the level of risk associated with customers, transactions, and geographical locations.

- Customer Due Diligence (CDD): Verifying the identity of clients and conducting enhanced due diligence for higher-risk clients.

- Transaction Monitoring: Using automated systems to monitor and flag unusual or suspicious transactions in real time.

- Suspicious Activity Reports (SARs): Reporting suspicious transactions to the relevant financial authorities.

- AML Training & Awareness: Ensuring all employees are trained to recognise red flags and report suspicious activity.

- Record Keeping: Maintaining records of customer information, transactions, and reports in accordance with legal requirements.

The importance of AML compliance cannot be overstated, as it serves to protect the integrity of the global financial system. Criminals are continually evolving their techniques, using increasingly sophisticated methods to launder money. As such, AML frameworks must be equally adaptable, incorporating the latest technologies and regulatory developments to stay ahead of financial criminals.

Banks, fintech companies, estate agents, and other sectors all have a role to play in this global effort. Through robust AML compliance programmes that include risk-based approaches, comprehensive customer due diligence, and effective transaction monitoring, organisations can reduce their exposure to money laundering risks and help combat financial crime on a global scale.

Know Your Customer (KYC) and Customer Due Diligence (CDD)

What is KYC?

Know Your Customer (KYC) refers to the process of a financial institution or business verifying the identity of its clients to prevent fraud, money laundering, and financing of terrorism. KYC is a critical component of a firm’s anti-money laundering (AML) compliance programme. The KYC process involves collecting and verifying information about the client’s identity, financial activities, and risk profile.

Importance of KYC in AML

KYC is pivotal in the fight against money laundering and terrorism financing. By thoroughly understanding their customers, organisations can assess the risk posed by each client, allowing them to implement appropriate controls to mitigate those risks. Effective KYC procedures help prevent illicit activities, enhance customer trust, and comply with regulatory requirements, thereby safeguarding the institution’s reputation and financial integrity.

KYC Procedures

KYC procedures typically include:

Customer Identification: Establishing and verifying the identity of the customer using reliable documents, such as passports, national ID cards, or utility bills.

Customer Due Diligence (CDD): Involves evaluating the risk a customer poses based on various factors, including the nature of their business and geographic location. CDD can be further classified into:

- Enhanced Due Diligence (EDD): Applied to high-risk customers, involving a deeper investigation into their financial history and transactions.

- Simplified Due Diligence (SDD): For lower-risk customers, where a less stringent process is acceptable.

KYC in Different Sectors

KYC in Banking

In the banking sector, KYC processes are integral to risk management. Banks are required to conduct thorough KYC checks at the outset of a customer relationship and periodically thereafter. This helps them monitor customer transactions for any suspicious activity, ensuring compliance with the Financial Action Task Force (FATF) recommendations and local regulations.

KYC in Estate Agencies

Estate agents must also implement KYC procedures to verify the identity of their clients, particularly when dealing with high-value properties. This helps prevent money laundering through real estate transactions, a common method for laundering illicit funds.

KYC for High-Risk Customers

High-risk customers, including politically exposed persons (PEPs) and those from high-risk jurisdictions, necessitate enhanced scrutiny. EDD procedures must be applied, which may involve obtaining additional documentation, conducting background checks, and ongoing monitoring of their transactions.

KYC Compliance Checklist

To ensure compliance with KYC regulations, organisations should consider the following checklist:

- Identification: Verify identity using government-issued IDs or passports.

- Address Verification: Collect proof of address through utility bills or bank statements.

- Source of Funds: Understand where the customer’s funds originate from.

- Risk Assessment: Classify customers based on risk levels.

- Record Keeping: Maintain comprehensive records of all customer information and transactions.

- Ongoing Monitoring: Regularly review customer accounts and transactions for any changes in risk profile.

KYC and AML Integration

KYC and AML processes are interconnected; KYC provides the foundation for effective AML strategies. By knowing their customers, institutions can more effectively monitor for suspicious transactions and implement appropriate responses when red flags arise.

KYC for Anti-Terrorism Financing

KYC is also essential in combatting terrorism financing. By understanding their customers and their transactions, organisations can identify patterns indicative of potential funding for terrorist activities. This requires diligent monitoring and reporting of any suspicious activities to the relevant authorities.

Electronic KYC (eKYC) Systems

The emergence of technology has led to the development of electronic KYC (eKYC) systems, which facilitate remote identity verification. These systems utilise digital tools such as biometrics, artificial intelligence, and blockchain technology to streamline the KYC process, ensuring a secure and efficient customer onboarding experience.

AML Transaction Monitoring

What is AML Transaction Monitoring?

AML transaction monitoring is the process of analysing customer transactions to identify patterns or behaviours indicative of money laundering or other financial crimes. This ongoing scrutiny is vital for detecting suspicious activities that may warrant further investigation or reporting.

Role of Transaction Monitoring in AML

Transaction monitoring plays a crucial role in AML compliance by enabling institutions to detect unusual activities that could indicate illicit behaviour. Effective monitoring systems can alert compliance teams to potential risks, allowing them to take appropriate action, such as filing Suspicious Activity Reports (SARs) or conducting further investigations.

AML System

An effective AML system should incorporate robust transaction monitoring capabilities that analyse customer behaviour in real-time. This involves setting thresholds for various transaction types and monitoring for any deviations from established patterns.

Types of Suspicious Transactions

Various types of transactions may be flagged during monitoring, including:

- Unusual Large Transactions: Transactions that significantly exceed a customer’s normal activity.

- Round Sum Payments: Payments made in round figures that could indicate an attempt to conceal the true nature of the transaction.

- Frequent Cash Deposits: Regular large cash deposits that are inconsistent with the customer’s known financial activities.

AML Software for Transaction Monitoring

Automated Transaction Monitoring Systems

Many institutions use automated transaction monitoring systems that employ algorithms to flag suspicious transactions for review. These systems can significantly enhance efficiency and accuracy, reducing the potential for human error.

Machine Learning and AI for Transaction Monitoring

Machine learning and artificial intelligence are increasingly utilised to improve transaction monitoring. These technologies can adapt and learn from new data, allowing for more sophisticated detection of suspicious patterns and behaviours over time.

AML Transaction Monitoring in Banks

Banks are required to have comprehensive transaction monitoring systems in place as part of their AML compliance framework. This includes regular audits of the monitoring system’s effectiveness and ensuring that staff are trained to recognise and respond to suspicious activities.

Transaction Monitoring for Non-Bank Financial Institutions

Non-bank financial institutions, such as money service businesses (MSBs) and payment processors, also face stringent transaction monitoring requirements. These entities must develop tailored monitoring systems that align with their specific risk profiles and transaction types.

AML Risk Assessment & Mitigation

What is AML Risk Assessment?

AML risk assessment involves identifying, evaluating, and prioritising risks associated with money laundering and terrorist financing. This process is essential for developing effective mitigation strategies and ensuring compliance with regulatory requirements.

Key Risk Indicators (KRIs) for AML

Key Risk Indicators (KRIs) are specific metrics used to assess the risk level associated with a customer or transaction. Common KRIs include:

- Customer Profile: The nature of the customer’s business and their geographical location.

- Transaction Patterns: Unusual transaction behaviours or high volumes.

- Source of Funds: The origin of funds and their legitimacy.

Risk-Based Approach (RBA) in AML

A Risk-Based Approach (RBA) allows institutions to allocate resources more efficiently by focusing on higher-risk areas. This involves:

- Assessing Customer Risk: Evaluating customers based on their risk profile.

- Geographic Risk: Identifying regions with higher risks of money laundering or terrorist financing.

- Product and Service Risk: Evaluating the risk associated with specific products or services offered.

AML Risk Assessment for Banks

Banks must conduct regular risk assessments to ensure compliance with regulatory expectations. This includes assessing the risk posed by customers, products, and geographic locations, and adapting their AML programmes accordingly.

AML Risk Assessment for Estate Agents

Estate agents also face unique risks in terms of money laundering through real estate transactions. It is vital for them to implement a robust risk assessment process to identify and mitigate these risks effectively.

AML Risk Mitigation Strategies

To mitigate AML risks, organisations should consider the following strategies:

- Implementing Robust KYC Procedures: Ensuring comprehensive customer identification and verification.

- Continuous Training: Providing staff with regular training on AML regulations and detection techniques.

- Utilising Technology: Employing advanced monitoring systems and analytics tools to detect suspicious activities.

Emerging AML Risks

As the financial landscape evolves, new risks emerge. Institutions must stay informed about:

- Risks Associated with Cryptocurrencies: The anonymous nature of many cryptocurrencies poses significant AML challenges.

- Cross-Border Financial Crimes: Increased globalisation and cross-border transactions complicate the detection of illicit activities.

AML Investigations and Reporting

What is an AML Investigation?

An AML investigation refers to the process of examining suspicious activities or transactions that may indicate money laundering or terrorist financing. These investigations are critical for compliance and must be conducted thoroughly and objectively.

Suspicious Activity Reports (SARs)

When suspicious activity is identified, institutions are required to file Suspicious Activity Reports (SARs) with the relevant authorities. SARs provide essential details about the suspicious activity and the parties involved.

Filing an SAR

Filing an SAR typically involves:

- Documenting the Suspicious Activity: Clearly detailing the nature of the activity and why it is deemed suspicious.

- Submitting the SAR: Providing the report to the appropriate regulatory body within the mandated time frame.

- Maintaining Confidentiality: Ensuring that the existence of the SAR and its contents remain confidential.

AML Investigations by Banks

Banks must have dedicated teams to conduct AML investigations. These teams analyse flagged transactions, gather additional information, and determine whether the activity warrants further action, including filing SARs.

AML Investigations by Financial Intelligence Units (FIUs)

Financial Intelligence Units (FIUs) are governmental agencies responsible for receiving and analysing SARs. They play a crucial role in AML investigations, often collaborating with law enforcement to pursue criminal activities.

AML Reports & Analytics

Analytical tools are employed to assess trends and patterns in suspicious activities, enabling organisations to refine their AML strategies continually.

AML Audits and Reviews

Regular audits are essential to ensure compliance with AML regulations. These can be conducted internally or externally, with the aim of identifying any deficiencies in the organisation’s AML framework.

Internal AML Audits

Internal AML audits involve a systematic examination of an institution’s AML policies, procedures, and controls. The purpose is to assess the effectiveness of the AML programme, ensure compliance with regulatory requirements, and identify areas for improvement. Key elements of internal audits include:

- Reviewing Policies and Procedures: Ensuring that all AML policies are up-to-date and compliant with the latest regulations.

- Assessing KYC and CDD Processes: Evaluating the effectiveness of customer identification and due diligence procedures.

- Transaction Monitoring Analysis: Examining the transaction monitoring systems to ensure they are functioning correctly and effectively detecting suspicious activities.

- Training Effectiveness: Reviewing the adequacy of training provided to staff regarding AML regulations and procedures.

External AML Audits

External audits are conducted by independent third-party firms. These audits provide an objective assessment of the institution’s AML compliance and can help identify weaknesses in the AML framework. The external auditor will typically:

- Conduct Interviews: Speak with staff at various levels to understand the AML culture within the organisation.

- Review Documentation: Examine records related to KYC, transaction monitoring, and SARs to assess compliance.

- Provide Recommendations: Offer actionable insights to enhance the organisation’s AML programme based on their findings.

AML Data & Analytics

Data collection and analysis are integral to effective AML compliance. Institutions must ensure that they have robust systems in place to gather and analyse relevant data. Key considerations include:

Data Collection and Storage

- Comprehensive Data Management: Collecting data from various sources, including customer profiles, transaction records, and external databases.

- Secure Storage: Ensuring that all AML-related data is stored securely to protect it from breaches and unauthorised access.

Role of Big Data in AML Investigations

Big data analytics plays a significant role in enhancing AML investigations. By leveraging large datasets, institutions can identify trends, correlations, and anomalies that may indicate suspicious activities. This capability allows for more proactive monitoring and response strategies.

AML and Emerging Technologies

Role of Technology in AML

Technology has significantly transformed the landscape of AML compliance. Institutions now utilise a range of technological solutions to enhance their AML frameworks and improve operational efficiency. Key technologies include:

AI and Machine Learning

Artificial Intelligence (AI) and machine learning are increasingly used in AML compliance for their ability to analyse vast amounts of data and detect patterns indicative of illicit activities. These technologies enable:

- Automated Detection: Identifying suspicious transactions in real-time.

- Adaptive Learning: Continuously improving detection algorithms based on new data.

Blockchain for AML

Blockchain technology offers transparency and traceability, which can be advantageous in AML efforts. By using blockchain, institutions can enhance the tracking of transactions and verify the legitimacy of funds. However, challenges remain in integrating blockchain solutions with existing systems.

Robotic Process Automation (RPA)

RPA is employed to automate repetitive tasks within AML processes, such as data entry and report generation. This allows compliance teams to focus on more complex tasks, such as investigations and strategy development.

AML Software Solutions

Numerous software solutions are available to assist with AML compliance. These systems typically offer features such as:

- Transaction Monitoring: Real-time analysis of transactions for suspicious activity.

- Risk Assessment Tools: Automated assessments of customer risk profiles.

- SAR Filing Assistance: Simplifying the process of filing SARs with regulatory bodies.

Top AML Systems and Platforms

Leading AML software platforms often incorporate a combination of the above technologies, offering comprehensive solutions tailored to meet regulatory requirements and enhance operational efficiency.

Regtech Solutions for AML Compliance

Regtech (regulatory technology) focuses on leveraging technology to streamline compliance processes. This includes solutions for real-time monitoring, regulatory reporting, and data management, enabling organisations to meet AML obligations more efficiently.

Cryptocurrency and AML

The rise of cryptocurrencies poses unique challenges for AML compliance. Due to the anonymity and decentralisation associated with cryptocurrencies, it is essential for financial institutions to implement robust measures to monitor and report suspicious activities related to digital assets.

Digital Identity and AML Compliance

Digital identity solutions can enhance KYC processes by providing secure, verifiable identification methods. This is particularly beneficial for remote customer onboarding and ensuring compliance with AML regulations.

eKYC Systems and Blockchain Technology

The integration of eKYC systems with blockchain technology can enhance the security and efficiency of customer verification processes. By using blockchain, institutions can access verified customer information in real-time, reducing the risk of identity fraud.

Sector-Specific AML Requirements

AML in Banking

Banks are at the forefront of AML efforts due to their central role in the financial system. They are required to implement comprehensive AML programmes that include KYC procedures, transaction monitoring, and regular audits to ensure compliance with regulations.

AML for Non-Bank Financial Institutions

Non-bank financial institutions, such as payment processors and money transfer services, are also subject to AML regulations. They must develop tailored compliance programmes that address their unique risks and regulatory requirements.

AML for Real Estate

Real estate transactions are often exploited for money laundering. Therefore, estate agents must implement KYC procedures and monitor transactions closely to prevent the misuse of property for laundering illicit funds.

AML for the Insurance Sector

The insurance industry must assess the risk of money laundering in policy sales and claims processing. KYC and transaction monitoring procedures should be integrated into their operations to identify and report suspicious activities.

AML for Casinos and Gaming

Casinos and gaming establishments face unique AML challenges due to the high volume of cash transactions. Effective KYC processes, transaction monitoring, and employee training are critical in preventing money laundering activities in this sector.

AML for Charities and Non-Profits

Charities and non-profit organisations must also implement AML measures to prevent misuse of funds. This includes verifying donors and ensuring transparency in financial transactions.

AML for High-Value Dealers (Art, Antiques, Precious Metals)

High-value dealers in art, antiques, and precious metals are often targeted for money laundering. They must establish KYC procedures and monitor transactions for suspicious activity, particularly in high-value sales.

Remediation Action Plan for AML Compliance

What is a Remediation Action Plan?

A Remediation Action Plan is a strategic framework designed to address deficiencies identified in an institution’s AML programme. It outlines the steps necessary to rectify compliance issues and strengthen the overall AML framework.

Essential Steps for AML Compliance Remediation

Corrective Actions

Organisations must take immediate corrective actions to address any compliance gaps. This may involve enhancing KYC procedures, improving transaction monitoring systems, or providing additional training to staff.

Updating AML Policies

Regularly updating AML policies is crucial to ensure alignment with the latest regulations and best practices. Institutions should conduct comprehensive reviews of their policies and procedures to identify necessary updates.

Responding to Regulatory Audits

When regulatory audits identify deficiencies, institutions must respond promptly and effectively. This includes implementing corrective measures and maintaining open communication with regulators to demonstrate commitment to compliance.

Best Practices for AML Remediation

To ensure effective AML remediation, organisations should consider the following best practices:

- Establishing a Compliance Culture: Foster a culture of compliance throughout the organisation, ensuring that all employees understand their role in AML efforts.

- Continuous Training and Awareness: Provide ongoing training to staff on AML regulations, emerging risks, and compliance best practices.

- Regular Monitoring and Review: Continuously monitor and review AML processes to identify areas for improvement and adapt to changing regulatory requirements.

KYC and AML are essential components of financial integrity and security. By implementing robust processes and leveraging technology, organisations can mitigate risks, comply with regulations, and contribute to the global fight against money laundering and terrorism financing. As the landscape evolves, continuous improvement and adaptation will be critical to maintaining effective compliance programmes.

About Neotas Due Diligence

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team. It’s a world-first, searching beyond Google. Neotas’ diligence uncovers illicit activities, reducing financial and reputational risk.

Neotas is a leader in harnessing the combined power of open-source intelligence (OSINT), along with social media, and a wide range of traditional data sources using cutting edge technology to deliver comprehensive AML solutions. We help uncover hidden risks using a combination of technology and our team of over 100 trained research analysts to protect our customers from making risky investment or other business decisions.

- Complete, Automated AML Solutions – Tailored to meet regulatory requirements for detecting and preventing money laundering activities.

- Seamless, Easy-to-Use Platform – Featuring interactive dashboards and management tools for efficient oversight.

- Single Workflow Platform – Consolidating all AML operations into a unified, easy-to-navigate system.

- OSINT-Driven Intelligence – Incorporating unstructured and structured data from open sources to uncover hidden risks.

- Dynamic Monitoring & Alerts – Real-time monitoring of individuals, entities, and transactions, with risk-based alert frequencies.

- Enhanced Due Diligence – Comprehensive checks on high-risk entities, including AML Regulated organisations, vendors, and customers.

- Seamless Integration – Easily integrates with existing AML, KYC, and compliance systems.

- Managed Service Option – Access to expert-driven, report-based AML assessments.

- Comprehensive Value Chain Monitoring – Covering all relevant actors, from customers to intermediaries and vendors.

Our automated AML monitoring continually tracks high-risk individuals and entities, providing immediate alerts on any significant changes or suspicious activities.

Neotas is a leading SaaS platform widely deployed by organisations for investigating suspected financial crime.

AML Case Studies:

AML Case Studies:

- Case Study: OSINT for EDD & AML Compliance

- Overcoming EDD Challenges on High Risk Customers

- Neotas Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- ESG Risks Uncovered In Investigation For Global Private Equity Firm

- Management Due Diligence Reveals Abusive CEO

- Ongoing Monitoring Protects Credit Against Subsidiary Threat

- AML Compliance and Fraud Detection – How to Spot a Money Launderer and Prevent It

AML Solutions:

AML Solutions:

- Risk-Based Approach (RBA) to AML & KYC risk management

- Anti-Money Laundering (AML) Compliance

- Anti-Money Laundering (AML) Checks

- Anti-Money Laundering (AML) Regulations

- Anti-Money Laundering (AML) Compliance Checklist

- Anti-Money Laundering (AML) Compliance Checklist for Banks

- Anti-Money Laundering (AML) Transaction Monitoring

- Money Laundering Reporting Officer (MLRO) – Roles and Responsibilities of an MLRO

- What is Customer Due Diligence in Banking and Financial Services?

Manage Financial Compliance and Business Risk with Neotas AML Solutions.

Neotas is an Enhanced Due Diligence Platform that leverages AI to join the dots between Corporate Records, Adverse Media and Open Source Intelligence (OSINT).

Schedule a Call or Book a Demo of Neotas Anti-money laundering (AML) Solutions.

Download the AML Checklist

Download the AML Checklist

An Actionable guide to prepare for AML Compliance

FAQs on Anti-money laundering (AML)

The AML KYC process involves verifying the identity of clients to prevent money laundering and other illicit financial activities. It includes collecting and analysing customer information, assessing the risk of potential money laundering activities, and continuously monitoring transactions. This ensures compliance with regulatory requirements and protects financial institutions from being exploited for illegal activities.

AML rules are regulatory guidelines designed to combat money laundering and financial crimes. They require financial institutions to implement robust policies and procedures for identifying and reporting suspicious activities. Key components include customer identification, transaction monitoring, record-keeping, and employee training. These rules vary by jurisdiction but generally aim to create a transparent financial environment.

AML processes include several key steps:

- Customer Due Diligence (CDD): Collecting and verifying customer information.

- Transaction Monitoring: Continuously reviewing transactions for suspicious activity.

- Reporting: Notifying relevant authorities of any suspicious transactions.

- Record-Keeping: Maintaining comprehensive records of customer interactions and transactions for a specified period.

- Risk Assessment: Evaluating the risk level associated with clients and transactions.

AML refers to the set of laws, regulations, and procedures that prevent, detect, and report money laundering activities. Money laundering, on the other hand, is the act of concealing the origins of illegally obtained money to make it appear legitimate. In essence, AML is the framework designed to combat the crime of money laundering.

An AML tool is software or a system used by financial institutions to automate and streamline AML compliance processes. These tools typically include features for customer screening, transaction monitoring, risk assessment, and reporting of suspicious activities. They help institutions efficiently manage large volumes of data and enhance compliance with regulatory requirements.

The three stages of AML are:

- Placement: The initial introduction of illegal funds into the financial system.

- Layering: Conducting complex transactions to obscure the origins of the money.

- Integration: Reintroducing the laundered funds into the economy as seemingly legitimate earnings.

An AML checklist is a comprehensive guide used by financial institutions to ensure compliance with AML regulations. It typically includes steps for customer identification, risk assessment, transaction monitoring, reporting obligations, and employee training. This checklist serves as a practical tool to confirm that all necessary actions are taken to mitigate risks associated with money laundering.

The four pillars of an AML policy are:

- Risk Assessment: Identifying and evaluating potential risks related to money laundering.

- Internal Controls: Establishing procedures and systems to manage identified risks.

- Employee Training: Providing staff with knowledge and skills to recognise and respond to AML issues.

- Independent Audit: Conducting regular assessments of the AML programme to ensure effectiveness and compliance.

AML is primarily regulated by government authorities and financial regulatory bodies. In the UK, the Financial Conduct Authority (FCA) and the National Crime Agency (NCA) are key players in enforcing AML regulations. These bodies set guidelines, monitor compliance, and impose penalties for non-compliance.

AML documents refer to records required for compliance with AML regulations. These may include customer identification documents (such as passports or utility bills), transaction records, risk assessment reports, and records of suspicious activity reports submitted to authorities. Proper documentation is essential for demonstrating compliance during audits or investigations.

Yes, KYC is an integral part of AML. KYC refers specifically to the process of verifying the identity of clients and assessing their risk profiles. By implementing effective KYC measures, financial institutions can significantly enhance their AML efforts, as understanding the customer is crucial to identifying suspicious activities.

The five pillars of AML typically include:

- Risk Assessment: Identifying and assessing the risks associated with money laundering.

- Policies and Procedures: Developing and implementing policies to mitigate risks.

- Compliance Officer: Appointing a designated officer responsible for AML compliance.

- Employee Training: Ensuring staff are trained in AML regulations and procedures.

- Independent Audit: Conducting regular audits to evaluate the effectiveness of the AML programme.

AML works by establishing a framework of laws and regulations that require financial institutions to identify, assess, and report suspicious activities. Institutions must implement policies for customer identification, transaction monitoring, and record-keeping, which collectively help to deter and detect money laundering activities. By adhering to these regulations, organisations contribute to the overall integrity of the financial system.

Common tools used in AML include:

- Customer Screening Software: For checking clients against sanction lists and politically exposed persons (PEPs).

- Transaction Monitoring Systems: To analyse transactions in real time for unusual patterns.

- Case Management Systems: For documenting and managing suspicious activity investigations.

- Reporting Tools: For automating the submission of reports to regulatory bodies.

The first stage in AML is Placement, where illicit funds are introduced into the financial system. This could involve depositing cash in banks, purchasing assets, or making large cash transactions. The objective at this stage is to disguise the illegal origin of the funds before they undergo layering.

Client Due Diligence (CDD) is the process of verifying a client’s identity and assessing their risk profile as part of KYC. CDD involves collecting personal information, conducting background checks, and evaluating the purpose of the business relationship. Enhanced Due Diligence (EDD) is applied for higher-risk clients to obtain additional information.

The KYC life cycle includes the following stages:

- Client Identification: Verifying the identity of the client.

- Risk Assessment: Evaluating the risk level associated with the client.

- Ongoing Monitoring: Continuously monitoring transactions and client activities for suspicious behaviour.

- Periodic Review: Regularly reassessing the client’s information and risk profile to ensure compliance.

Red flags in AML are indicators that suggest potential money laundering activities. Common red flags include:

- Large cash deposits inconsistent with the client’s profile.

- Frequent or unusual international wire transfers.

- Clients reluctant to provide information or documentation.

- Transactions involving high-risk jurisdictions.

Client Due Diligence (CDD) is the standard process of verifying customer identity and assessing risk. Enhanced Due Diligence (EDD) is applied to clients considered higher risk, requiring more comprehensive checks, such as detailed source of funds investigations, to mitigate the risk of money laundering or terrorist financing.

The consequences of non-compliance with AML regulations can be severe. Financial institutions may face significant fines, penalties, or sanctions imposed by regulatory authorities. Additionally, non-compliance can lead to reputational damage, loss of business, and increased scrutiny from regulators. In extreme cases, institutions may even lose their licenses to operate.

The key challenges in implementing an effective AML programme include:

- Complexity of Regulations: Navigating various laws and regulations across different jurisdictions can be challenging.

- Resource Allocation: Ensuring adequate resources—both human and technological—are available for effective AML compliance.

- Data Management: Handling large volumes of data while ensuring accurate and timely reporting of suspicious activities.

- Keeping Up with Emerging Risks: Adapting to evolving tactics used by criminals, including new technologies and methods for money laundering.

The Money Laundering Reporting Officer (MLRO) is a designated individual within a financial institution responsible for overseeing the organisation’s AML compliance programme. The MLRO’s key responsibilities include:

- Monitoring Compliance: Ensuring that the institution adheres to relevant AML regulations and internal policies.

- Reporting Suspicious Activity: Evaluating and reporting suspicious transactions to the relevant authorities, such as the National Crime Agency (NCA) in the UK.

- Risk Assessment: Conducting assessments of the risks associated with money laundering and implementing measures to mitigate those risks.

- Training and Awareness: Providing training and guidance to employees about AML regulations and the identification of suspicious activities.

- Liaison with Regulators: Acting as the main point of contact with regulatory bodies regarding AML matters and audits.

The contribution of the MLRO to the effectiveness of an AML programme is significant due to their comprehensive oversight and strategic role. Key contributions include:

- Leadership: The MLRO sets the tone for AML compliance within the organisation, ensuring that it is prioritised at all levels.

- Policy Development: They are involved in developing and updating AML policies and procedures to align with regulatory requirements and industry best practices.

- Data Analysis: The MLRO analyses transaction data and patterns, utilising insights to strengthen monitoring systems and identify potential vulnerabilities.

- Incident Management: They manage incidents of suspected money laundering, guiding the institution through the reporting process and any subsequent investigations.

- Continuous Improvement: By regularly reviewing and assessing the AML programme’s effectiveness, the MLRO facilitates continuous improvement and adaptation to new risks.

- Last Updated on April 10, 2025

financial crime compliance

financial crimes compliance

what is financial crime compliance

financial crime and compliance

financial crime and compliance management

financial crime compliance jobs

financial crime compliance solutions

financial crimes compliance jobs

compliance and financial crime

cost of financial crime compliance

enterprise financial crimes compliance

fcc financial crime compliance

anti financial crime compliance

conduct financial crime and compliance

financial crime compliance analyst

financial crime compliance analyst salary

financial crime compliance certification

financial crime compliance course

financial crime compliance definition

financial crime compliance framework

financial crime compliance in banking

financial crime compliance meaning

financial crime compliance risk management

global financial crimes compliance

true cost of financial crime compliance global report

what is financial crimes compliance

Share:

Neotas Enhanced Due Diligence

Neotas Enhanced Due Diligence covers 600Bn+ Archived web pages, 1.8Bn+ court records, 198M+ Corporate records, Global Social Media platforms, and more than 40,000 Media sources from over 100 countries to help you screen & manage risks.

Index

Index

- History and Evolution of AML

- Importance of AML in the Global Economy

- Key Definitions: AML, CFT, Financial Crime, and Money Laundering

- Types of Money Laundering

- Impact of Money Laundering on the Economy and Society

- Stages of Money Laundering

- Placement

- Layering

- Integration

- Examples of Money Laundering

- Emerging Trends in Money Laundering

- Cryptocurrency and Digital Currency Laundering

- Trade-Based Money Laundering (TBML)

- Virtual Assets and Blockchain Technology

- Global AML Regulatory Bodies

- Financial Action Task Force (FATF)

- European Union AML Directives (EU AMLD)

- Basel Committee on Banking Supervision (BCBS)

- AML Regulations by Country/Region

- AML Regulations UK

- AML Regulations US

- AML Regulations EU

- AML/CFT Compliance Requirements

- AML Legislation & Laws

- UK Proceeds of Crime Act

- US Patriot Act & Bank Secrecy Act

- EU 5th and 6th AML Directives

- AML Laws for Banks & Financial Institutions

- AML Laws for Estate Agents and Other Industries

- What is AML Compliance?

- AML Compliance Checklist

- AML Compliance Programme Development

- Key Components of an AML Compliance Program

- Risk-Based Approach

- Policies and Procedures

- AML Governance & Senior Management Roles

- Staff Training & Awareness

- AML Compliance in Banking

- AML Compliance for Non-Banking Sectors

- AML for Estate Agents

- AML for Fintechs

- AML and CFT Integration

- Combating the Financing of Terrorism (CFT)

- Differences Between AML & CFT

- What is KYC?

- Importance of KYC in AML

- KYC Procedures

- Customer Identification

- Enhanced Due Diligence (EDD)

- Simplified Due Diligence (SDD)

- KYC in Different Sectors

- KYC in Banking

- KYC in Estate Agencies

- KYC for High-Risk Customers

- KYC Compliance Checklist

- KYC and AML Integration

- KYC for Anti-Terrorism Financing

- Electronic KYC (eKYC) Systems

- What is AML Transaction Monitoring?

- Role of Transaction Monitoring in AML

- AML System

- Types of Suspicious Transactions

- Unusual Large Transactions

- Round Sum Payments

- Frequent Cash Deposits

- AML Software for Transaction Monitoring

- Automated Transaction Monitoring Systems

- Machine Learning and AI for Transaction Monitoring

- AML Transaction Monitoring in Banks

- Transaction Monitoring for Non-Bank Financial Institutions

- What is AML Risk Assessment?

- Key Risk Indicators (KRIs) for AML

- Risk-Based Approach (RBA) in AML

- Assessing Customer Risk

- Geographic Risk

- Product and Service Risk

- Transaction Risk

- AML Risk Assessment for Banks

- AML Risk Assessment for Estate Agents

- AML Risk Mitigation Strategies

- Emerging AML Risks

- Risks Associated with Cryptocurrencies

- Cross-Border Financial Crimes

- What is an AML Investigation?

- Suspicious Activity Reports (SARs)

- Filing an SAR

- AML Investigations by Banks

- AML Investigations by Financial Intelligence Units (FIUs)

- AML Reports & Analytics

- AML Audits and Reviews

- Internal AML Audits

- External AML Audits

- AML Data & Analytics

- Data Collection and Storage

- Role of Big Data in AML Investigations

- Role of Technology in AML

- AI and Machine Learning

- Blockchain for AML

- Robotic Process Automation (RPA)

- AML Software Solutions

- Top AML Systems and Platforms

- Regtech Solutions for AML Compliance

- Cryptocurrency and AML

- Digital Identity and AML Compliance

- eKYC Systems and Blockchain Technology

- AML in Banking

- AML for Non-Bank Financial Institutions

- AML for Real Estate

- AML for Insurance Sector

- AML for Casinos and Gaming

- AML for Charities and Non-Profits

- AML for High-Value Dealers (Art, Antiques, Precious Metals)

- What is a Remediation Action Plan?

- Essential Steps for AML Compliance Remediation

- Corrective Actions

- Updating AML Policies

- Responding to Regulatory Audits

- Best Practices for AML Remediation

- FAQs on AML

- AML Checklist – Download the Template

- AML Case Studies – Insights from Neotas

aml compliance checklist

aml compliance program

aml and bsa

aml ctf

aml and ctf

anti money laundering integration

fatf money laundering

bsa aml

money laundering transaction monitoring

aml transaction monitoring

anti money laundering transaction monitoring

aml checks

aml check

anti money laundering checks

aml checks uk

anti-money laundering check

money laundering checks

anti-money laundering checks

what is aml checks

money laundering check

what is an anti money laundering check

anti money laundering check

anti money laundering compliance

anti money laundering checks

aml and compliance

aml checks

anti-money laundering compliance

aml check

anti money laundering compliance

anti money laundering checks uk

what is an aml check

anti money laundering checks by banks

kyc checks

kyc compliance

kyc check

know your customer

know your customer checks

know your customer meaning

know your client

know your client regulations

aml kyc

what is anti money laundering

kyc requirements

aml money laundering

kyc regulations

anti money laundering regulations

aml regulations

money laundering regs

aml finance

aml compliance

aml regs

aml and compliance

know your customer compliance

kyc and compliance

money laundering laws

anti-money laundering compliance

types of anti money laundering

aml system

anti money laundering types

law for money laundering

anti money laundering

aml comply

kyc aml

aml in banking

aml requirements

aml procedures

anti money laundering requirements

anti money laundering in banking

anti money laundering procedures

kyc and aml compliance

kyc money laundering

aml reports

aml kyc process

anti money laundering and compliance

kyc aml compliance

kyc aml procedures

money laundering process

aml integration

aml risk assessment

banks and money laundering

money laundering risk

anti money laundering investigation

aml check meaning

what are aml checks

aml checks meaning

aml search

aml checker

anti money laundering search

aml check online

money laundering

cash laundering

laundering

anti money laundering checks for estate agents

anti money laundering audit

anti money laundering companies

bank money laundering

aml data

anti money laundering compliance program

aml check estate agents

money laundering checks for estate agents

anti money laundering finance

anti money laundering services

aml

aml audit

bsa banking

anti money laundering consultant

aml sanctions

aml insurance

aml sanctions screening

peps money laundering

anti money laundering checks

aml finance

aml and compliance

aml checks

aml compliance

anti-money laundering compliance

aml check

anti money laundering compliance

aml checks

aml check

anti money laundering checks

aml checks

money laundering checks

aml check meaning

anti-money laundering check

aml checks uk

anti-money laundering checks

what are aml checks

what is aml checks

aml checks meaning

money laundering check

what is an anti money laundering check

anti money laundering check

aml search

anti money laundering compliance

kyc

what is kyc verification

kyc compliance

kyc meaning

kyc verification

kyc identity verification

what is kyc

know your customer

know your client

kyc know

kyc definition

what are kyc

kyc documents

kyc process

what is know your customer

kyc aml

kyc know your client

kyc requirements

kyc what

know your customer requirements

kyc customer

kyc means

what is a kyc

what is kyc in banking

what does kyc mean

micromerchant

kyc software

kyc/aml

define kyc

kyc check

kyc services

kyc checks

kyc banking

bank know your customer

know your customer regulations

kyc document

kyc required

kyc regulations

meaning of know your customer

know your customer banking

kyc full form

kyc in banking

know your customer bank

know your customer rule

kyc meaning in banking

know your customer process

what does kyc stand for

know your customer news

know your client regulations

kyc information

kyc procedure

aml kyc

kyc and aml

kyc verification meaning

kyc due diligence

whats kyc

kyc know your customer

kyc law

kyc finance

aml kyc meaning

know your customer laws

aml and kyc

kyc requirements for banks

aml/kyc

aml check

kyc laws

corporate secrecy

kyc bank

how to launder cash

anti money laundering

aml

money laundering

cash laundering

laundering

bsa banking

law for money laundering

aml compliance

anti money laundering compliance

aml and compliance

anti money laundering and compliance

aml comply

aml checks

kyc aml

anti money laundering checks

anti money laundering regulations

aml finance

aml regulations

aml ctf

anti money laundering finance

aml and ctf

aml integration

aml regs

anti money laundering integration

bsa aml

aml and bsa

kyc compliance

aml in banking

know your customer compliance

anti money laundering in banking

money laundering regs

fatf money laundering

aml transaction monitoring

anti money laundering transaction monitoring

aml requirements

anti money laundering requirements

anti money laundering consultant

bank money laundering

banks and money laundering

aml audit

aml risk assessment

aml procedures

anti money laundering audit

anti money laundering procedures

aml reports

kyc aml compliance

kyc and aml compliance

anti money laundering services

anti money laundering companies

anti money laundering investigation

aml compliance program

aml kyc process

anti money laundering compliance program

kyc aml procedures

peps money laundering

anti money laundering checks for estate agents

aml insurance

aml sanctions

aml check estate agents

aml data

money laundering checks for estate agents

money laundering risk