Money Laundering

Money laundering is the process of making illegally obtained money—often referred to as “dirty money”—appear as though it was acquired through legitimate sources. In other words, it’s about hiding the origin of money earned from crimes like drug trafficking, corruption, or fraud, so it can be used without attracting attention from the authorities.

For criminals, laundering their money is essential because it allows them to profit from their illegal activities while avoiding detection and prosecution. Without laundering, criminals would be unable to freely spend or invest their ill-gotten gains. Thus, they devise intricate schemes to incorporate this dirty money into the financial system, making it blend in with legally obtained funds. When successful, they can then use it to buy property, invest in businesses, or even expand their illegal operations—all while staying under the radar.

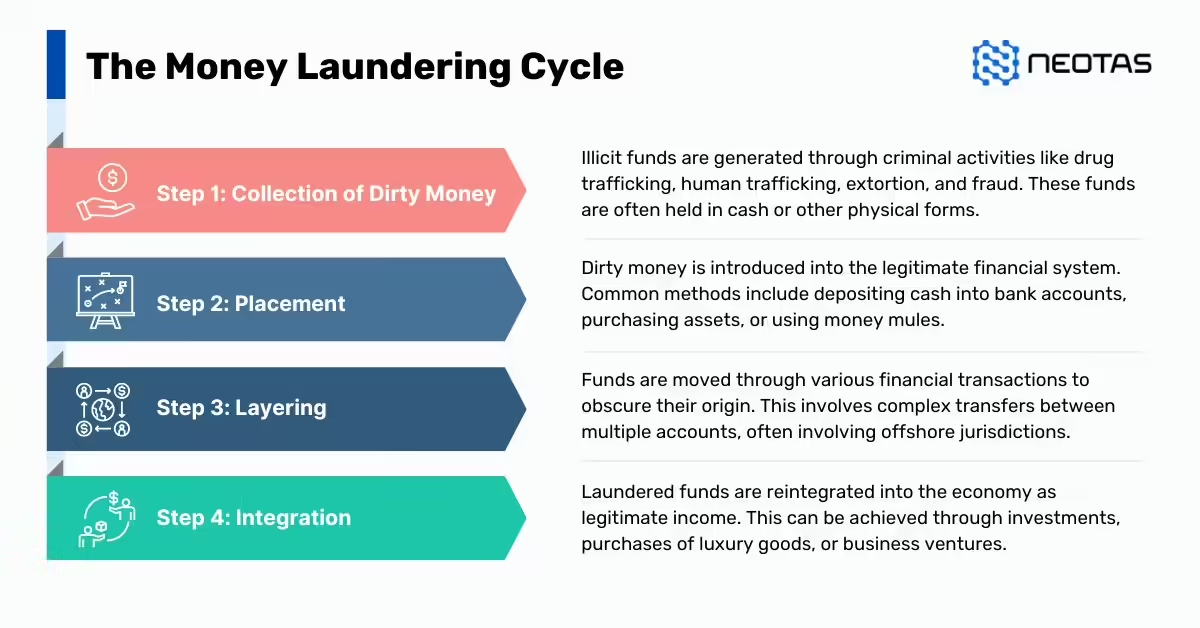

Money Laundering Process

The process of money laundering is typically broken down into three main stages: Placement, Layering, and Integration. Each stage is designed to achieve a specific goal, and they work together to convert “dirty” money into “clean” money that looks like it came from legitimate sources.

- Placement: The first point of entry where illicit funds are introduced into the financial system.

- Layering: The phase where the funds are moved around to make them harder to trace.

- Integration: The stage where the funds are finally brought back into the legal economy, making it appear as if they were legitimately earned.

Let’s break down each stage to understand how money laundering works in practice.

Money Laundering Cycle

Understanding the three stages of Money Laundering

The money laundering cycle is a structured process that criminals use to disguise the origins of illegally obtained money, making it appear as though it came from legitimate sources. This cycle is critical because it enables criminals to benefit from illicit activities without drawing attention from regulatory authorities or law enforcement. Understanding the money laundering cycle is essential for identifying, detecting, and combating financial crimes effectively.

The money laundering cycle is typically divided into three main stages: Placement, Layering, and Integration. Each stage plays a crucial role in converting “dirty” money into “clean” money that can be freely used within the legitimate economy. Let’s delve into each stage to get a clearer picture of how the process unfolds.

Stage 1: Placement

Placement is the first step in the money laundering cycle, where illicit funds are introduced into the financial system. This is often considered the most risky stage for money launderers because large or unusual cash transactions are likely to attract attention from financial institutions or regulators. Criminals, therefore, employ a variety of tactics to avoid detection and scrutiny during placement.

Key Techniques Used in the Placement Stage:

- Smurfing (Structuring): Breaking down large amounts of cash into smaller, less suspicious transactions spread across multiple accounts or banks. For example, instead of depositing £100,000 in one go, the launderer might make multiple deposits of £9,000 to avoid triggering a Suspicious Activity Report (SAR).

- Cash-Intensive Businesses: Blending illegal funds with legitimate business revenue. Businesses that handle a lot of cash, like restaurants, bars, casinos, or car washes, are commonly used. The illegal funds are mixed with daily revenue, making it difficult to distinguish between legal and illegal money.

- Purchasing Assets: Buying high-value items like luxury cars, real estate, or jewellery with cash. These assets can later be sold, providing a seemingly legitimate source of money.

- Cross-Border Transactions: Moving funds to different jurisdictions, especially those with lax AML regulations or strong bank secrecy laws, to avoid detection.

The goal of placement is to get the money into the financial system in such a way that it doesn’t raise suspicions and can be transferred or converted into other forms, making it harder to trace.

Stage 2: Layering

Layering is the second stage of the money laundering cycle. This stage is all about creating a complex web of financial transactions to obscure the audit trail and distance the money from its illegal source. The primary aim here is to confuse investigators and make it difficult, if not impossible, to trace the origin of the funds.

Key Techniques Used in the Layering Stage:

- Multiple Bank Transfers: Moving money between several bank accounts, often in different countries. This might involve jurisdictions with weak anti-money laundering (AML) controls or strict bank secrecy laws.

- Shell Companies and Trusts: Setting up companies or trusts in tax havens or offshore locations to disguise ownership. These entities can conduct transactions or hold assets without revealing the true identity of the launderer.

- Investment in Legitimate Ventures: Using funds to purchase assets like stocks, bonds, or real estate. By doing so, the illegal money is converted into a legitimate investment that can later generate lawful income.

- Cryptocurrency Transactions: Using digital currencies like Bitcoin for added anonymity. Techniques like chain-hopping (moving funds across different cryptocurrencies) and tumbling (mixing transactions to blur their origins) are commonly used in this stage.

- High-Value Asset Purchases and Resales: Buying luxury items like yachts, art, or diamonds. Once these are resold, the proceeds are much harder to trace back to their illegal origins.

The goal of layering is to create such a convoluted path that the money appears to come from a clean, legitimate source. By moving the funds through a series of transactions, criminals can make it exceedingly difficult for authorities to follow the money trail.

Stage 3: Integration

Integration is the final stage of the money laundering cycle. This is where the “cleaned” money is fully absorbed into the legitimate economy, making it appear as though it was acquired through lawful means. By the time money reaches this stage, it is often virtually indistinguishable from legally earned funds, allowing criminals to use it freely without suspicion.

Key Techniques Used in the Integration Stage:

- Business Investments and Acquisitions: Using laundered money to invest in or purchase legitimate businesses, which can then generate legal profits. This allows the launderer to further distance the funds from their criminal origin.

- Loans and Dividends: Creating fake loans that will never be repaid or issuing dividends through shell companies to distribute funds under the guise of legitimate financial activities.

- Real Estate and Property Development: Investing in real estate projects or purchasing properties for resale or rental income. Real estate is often used because of its ability to absorb large amounts of money and its potential for value appreciation.

- High-Value Personal Purchases: Buying luxury goods, such as vehicles, jewellery, or fine art. These purchases not only store value but also provide a legitimate-appearing use of funds.

- Employment Schemes and Payroll Manipulation: Setting up fake employees or businesses and channelling funds through payroll as legitimate business expenses.

The goal of integration is to fully legitimise the illicit funds so that they can be used for any purpose—business, investments, or personal expenditure—without raising any suspicion. By this stage, the money has been layered so effectively that proving its illicit origins becomes nearly impossible.

Understanding the money laundering cycle is crucial for financial institutions, regulators, and law enforcement agencies to identify and disrupt these activities at any stage. Each stage presents unique challenges and opportunities for detection, and knowing how criminals operate can help in devising better anti-money laundering (AML) strategies.

For financial professionals, the ability to spot red flags at the placement, layering, or integration stages can be the key to preventing money laundering from occurring. Likewise, strong collaboration between financial institutions and regulatory bodies is essential to track suspicious activities and implement effective countermeasures.

Common Techniques Used in Money Laundering

Money laundering methods evolve over time as launderers adapt to new regulations and enforcement techniques. The following are some of the most common methods:

- Smurfing and Structuring: Breaking large transactions into smaller ones to fly under the radar.

- Shell Companies and Offshore Accounts: Setting up companies in tax havens to obscure ownership and make tracing difficult.

- Cash-Intensive Businesses: Using businesses like car washes or bars, which handle a lot of cash, to disguise the source of the money.

- Cryptocurrency Methods: Using the anonymity of digital currencies and sophisticated techniques to avoid detection.

- Investing in Real Estate and High-Value Assets: Launderers use expensive assets to store and move value, complicating tracking efforts.

Global Impact of Money Laundering

Money laundering has far-reaching consequences that go beyond just financial losses. It impacts economies, societies, and even governance structures around the world. Understanding its broader effects can help underscore the importance of combating this crime.

Economic Impact:

- Distorted Markets and Unfair Competition: When criminals inject laundered money into the economy, it can distort legitimate markets, affect asset prices, and create unfair competition for lawful businesses.

- Lost Tax Revenue: Countries lose out on significant tax revenue when funds are moved or hidden abroad, depriving public services of much-needed resources.

- Financial Instability: Large-scale laundering can undermine the stability of financial institutions, especially in countries with weak AML controls.

Social and Political Impact:

- Funding Criminal Enterprises: Laundered money often funds activities like drug trafficking, human trafficking, and terrorism, contributing to social harm.

- Weakening Governance and Corruption: The influx of illicit funds can fuel corruption, weaken the rule of law, and erode public trust in institutions.

- Resource Misallocation: In developing countries, the presence of illicit funds can divert resources away from critical sectors like healthcare, education, and infrastructure, worsening inequality.

Importance of Combating Money Laundering

Combating money laundering is crucial for several reasons:

- Protecting Economic Stability: Robust AML measures help maintain the integrity of financial markets and ensure resources are allocated fairly.

- Ensuring National Security: Effective AML controls reduce the funding available for terrorism, organised crime, and other illegal activities.

- Upholding Business Integrity: Companies that comply with AML regulations avoid fines, legal action, and reputational damage.

- Strengthening Global Cooperation: Money laundering is a global issue, and combating it requires international collaboration and adherence to standards like those set by the Financial Action Task Force (FATF).

Money laundering is a complex, evolving crime that poses a serious threat to the global financial system and societal stability. Understanding how it works—the stages, techniques, and impacts—is crucial for anyone involved in financial regulation, compliance, or law enforcement. Tackling this issue requires robust local and international efforts, stronger regulatory frameworks, and unwavering commitment to compliance. With continued vigilance and cooperation, we can mitigate the risks of money laundering and contribute to a safer, more transparent financial world.

About Neotas Due Diligence

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team. It’s a world-first, searching beyond Google. Neotas’ diligence uncovers illicit activities, reducing financial and reputational risk.

💼 WHAT WE OFFER

- Complete, Automated AML Solutions – Tailored to meet regulatory requirements for detecting and preventing money laundering activities.

- Seamless, Easy-to-Use Platform – Featuring interactive dashboards and management tools for efficient oversight.

- Single Workflow Platform – Consolidating all AML operations into a unified, easy-to-navigate system.

- OSINT-Driven Intelligence – Incorporating unstructured and structured data from open sources to uncover hidden risks.

- Dynamic Monitoring & Alerts – Real-time monitoring of individuals, entities, and transactions, with risk-based alert frequencies.

- Enhanced Due Diligence – Comprehensive checks on high-risk entities, including AML Regulated organisations, vendors, and customers.

- Seamless Integration – Easily integrates with existing AML, KYC, and compliance systems.

- Managed Service Option – Access to expert-driven, report-based AML assessments.

- Comprehensive Value Chain Monitoring – Covering all relevant actors, from customers to intermediaries and vendors.

Our automated AML monitoring continually tracks high-risk individuals and entities, providing immediate alerts on any significant changes or suspicious activities.

Neotas is a leading SaaS platform widely deployed by organisations for investigating suspected financial crime.

📘AML Case Studies:

- Case Study: OSINT for EDD & AML Compliance

- Overcoming EDD Challenges on High Risk Customers

- Neotas Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- ESG Risks Uncovered In Investigation For Global Private Equity Firm

- Management Due Diligence Reveals Abusive CEO

- Ongoing Monitoring Protects Credit Against Subsidiary Threat

- AML Compliance and Fraud Detection – How to Spot a Money Launderer and Prevent It

💼 AML Solutions:

- Risk-Based Approach (RBA) to AML & KYC risk management

- Anti-Money Laundering (AML) Compliance

- Anti-Money Laundering (AML) Checks

- Anti-Money Laundering (AML) Regulations

- Anti-Money Laundering (AML) Compliance Checklist

- Anti-Money Laundering (AML) Compliance Checklist for Banks

- Anti-Money Laundering (AML) Transaction Monitoring

- Money Laundering Reporting Officer (MLRO) – Roles and Responsibilities of an MLRO

- What is Customer Due Diligence in Banking and Financial Services?

Manage Financial Compliance and Business Risk with Neotas AML Solutions.

Neotas is an Enhanced Due Diligence Platform that leverages AI to join the dots between Corporate Records, Adverse Media and Open Source Intelligence (OSINT).

🗓️ Schedule a Call or Book a Demo of Neotas Anti-money laundering (AML) Solutions.